Looking to enjoy life early? Here are some essential financial planning tips for Filipino millennials to achieve financial security.

The journey towards financial freedom is a learning process for everyone, but it holds unique challenges for millennials. Forbes reports that this generation faces conflicting views on finance, as they navigate traditional approaches in a modern world with its technological advancements. Moreover, many millennials lack exposure to financial literacy, making it harder to know where to begin. Coupled with the high cost of living in cities and their preferred lifestyle, becoming financially responsible requires substantial effort.

However, there’s no need to stress over every aspect of financial planning, such as passive income ideas or monitoring the stock market. Instead, focus on grasping the fundamental attitudes and habits. To help you get started, here are some financial planning tips specifically tailored for millennials.

- Create a Budget: Begin your journey to financial responsibility by developing a budget system. Tracking your spending on a weekly or monthly basis will show where your money goes. Allocate specific amounts for your purchases to prevent overspending, particularly when working with a tight budget. List down short-term and long-term financial goals to prioritize your financial needs effectively.

- Build Clear Financial Goals: Distinguish between short-term goals (to be achieved within a day, a week, a month, or up to a year) and long-term goals (to be achieved in five years or more). Short-term goals may include personal purchases, rent or credit card payments, or home improvement expenses. Long-term goals may involve retirement funds, education savings, passive income streams, business ventures, or purchasing a house.

- Build an Emergency Fund: Allocate a portion of your salary to create an emergency fund, which acts as a safety net for unexpected financial crises like medical emergencies, natural disasters, or unemployment. Consider saving three to six months’ worth of expenses, or even up to a year’s worth in case of economic downturns.

- Seek Additional Income: Given rising living costs and stagnant wages, consider pursuing extra income through online jobs or passive income streams. Online jobs with home-based setups can be conveniently done during your free time and may even lead to a new career path.

- Embrace a DIY Mindset: Save money by preparing meals instead of buying take-outs and buying groceries in bulk to save on transport and time. Recycle old items and upgrade them instead of constantly buying new ones. Tackle minor problems yourself to avoid unnecessary spending.

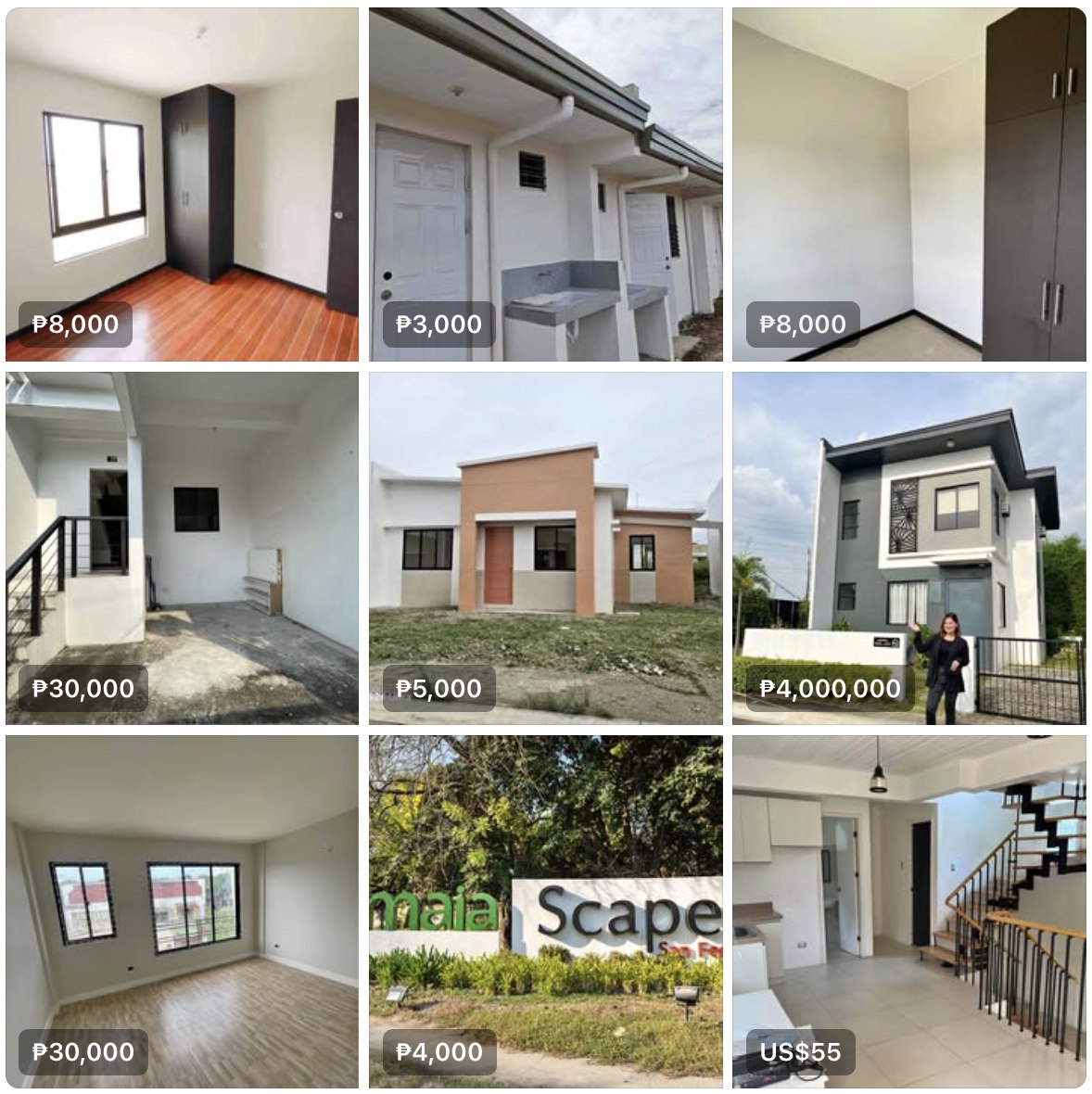

- Invest Wisely: Consider generating passive income through investments that align with your financial situation. Popular options for millennials include mutual funds, high-yield savings accounts, Variable Universal Life Insurance (VUL), and real estate investing.

- Educate Yourself: Prioritize financial literacy by reading finance books and online resources to improve your money management skills and gain confidence in making financial decisions.

- Adopt a Frugal Mindset: Be intentional with your purchases, avoid impulsive spending, and focus on the long-term benefits of saving. Train yourself to let go of bad spending habits and aim to live a debt-free life.

By following these financial planning tips, Filipino millennials can move closer to successful money management and eventually achieve their ultimate goal: financial freedom.