As we stand on the threshold of a new year, it’s time to set sail on a journey toward financial stability and growth. Welcome to 2024, where adopting the right financial habits can pave the way for a brighter future. Here are 24 achievable financial new year’s resolutions, designed to guide you toward a year of financial triumph.

1. Craft a Comprehensive Budget

Start by creating a budget that encompasses all your expenses and income. This tool will be your guiding light, illuminating where every dollar goes each month.

2. Monitor Spending Habits

Stay vigilant by tracking your expenses. Utilize apps or spreadsheets to understand your spending patterns and identify areas where cutbacks are feasible.

3. Set Clear Savings Goals

Establish specific savings targets for short-term needs, mid-term aspirations, and long-term financial security. These goals will be your roadmap to success.

4. Tackle High-Interest Debts

Prioritize paying off high-interest debts, especially credit cards. This action can save a significant amount in interest payments over time.

5. Automate Your Savings

Make savings effortless by setting up automatic transfers to dedicated savings accounts. Consistent savings, without relying on willpower alone, can make a remarkable difference.

6. Revisit and Adjust Your Investments

Regularly reassess your investment portfolio. Consider your risk tolerance and make adjustments to your allocations if needed.

7. Keep Educating Yourself Financially

Expand your financial literacy through various means – books, podcasts, courses, or seeking guidance from financial professionals. Knowledge is your power.

8. Build an Emergency Fund

Strive to have at least three to six months’ worth of living expenses saved in an easily accessible account. This fund acts as a safety net during unexpected emergencies.

9. Maximize Retirement Contributions

Contribute the maximum allowable amount to retirement accounts like SSS or GSIS. This step secures a your pension for when you retire

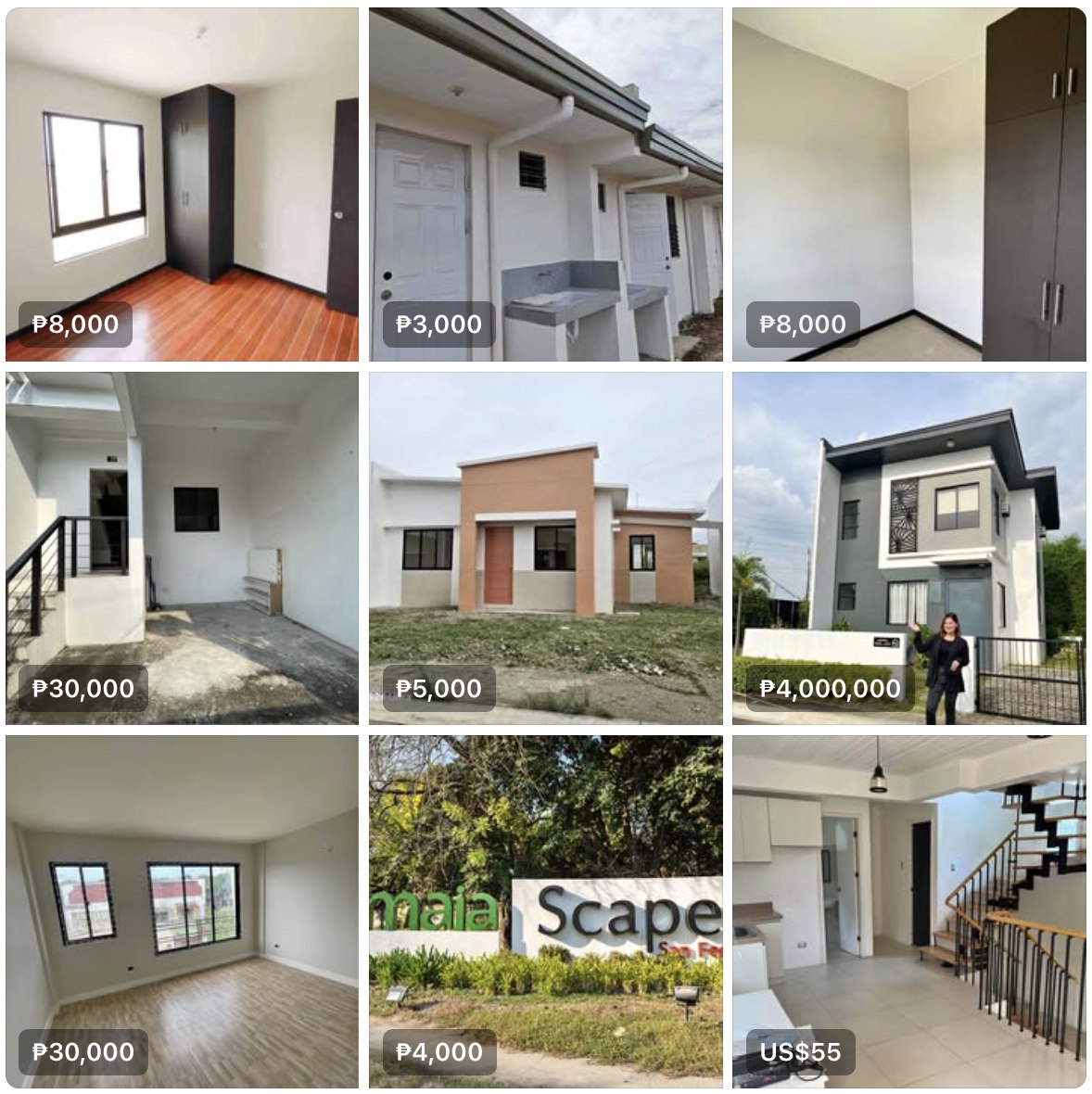

10. Explore Passive Income Avenues

Diversify your income streams. Consider investing in dividend-paying stocks, rental properties, or creating digital assets to bolster your finances.

11. Review Your Insurance Policies

Ensure you have adequate coverage across health, life, home, and auto insurance to safeguard against unforeseen circumstances.

12. Negotiate Your Bills

Be proactive in negotiating with service providers or exploring alternative options to reduce your monthly bills.

13. Diversify Your Income Sources

Explore freelancing, part-time work, or side businesses to reduce dependency on a single income stream.

14. Embrace Mindful Spending

Prioritize purchases that align with your values and add genuine value to your life. Practice restraint and thoughtful decision-making before spending.

15. Plan for Major Expenses

Anticipate big expenses like buying a house, car, or education. Create separate savings plans to meet these financial milestones.

16. Regularly Check Your Credit Reports

Keep an eye on your credit reports to spot errors or discrepancies that could potentially lead to bigger expenses.

17. Encourage Early Retirement Planning

Advocate for younger family members to start planning for retirement early. Teach them about the power of compound interest.

18. Take Advantage of Health Savings Accounts (HSAs/ Health Insurance)

Maximize contributions to Health insurance, now that different forms of sicknesses are rising, minimize healthcare expenses when the need arises

19. Embrace Giving Back

Incorporate charitable giving into your budget or dedicate time to volunteer for causes close to your heart.

20. Review and Update Your Estate Plans

Ensure your estate plans, wills, and beneficiaries align with your current circumstances and wishes.

21. Curb Impulse Buying

Implement a cooling-off period before significant purchases to reduce impulse buying tendencies. Goodbye to budol online check-outs

22. Invest in Self-Care

Remember, your mental and physical health are integral to financial well-being. Prioritize self-care practices for holistic wellness.

23. Network and Learn

Engage with peers or join financial communities to share experiences and gain insights into personal finance.

24. Celebrate Milestones

Lastly, acknowledge and celebrate your financial achievements. These celebrations reinforce positive financial habits.

In conclusion, these resolutions serve as a blueprint for a financially successful 2024 and beyond. Consistency, perseverance, and a commitment to these goals will pave the way to financial freedom. Here’s to a year filled with financial prosperity and growth!