What to know about Vehicle Insurance

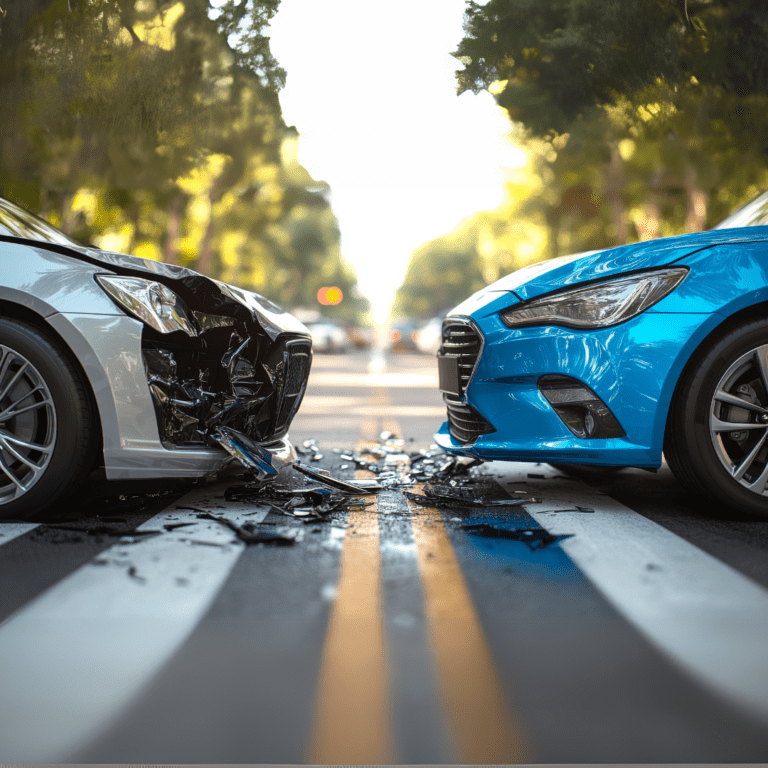

Understanding Vehicle Insurance

Vehicle insurance is a financial safety net that protects you and your vehicle from unexpected accidents, theft, and other losses. By having vehicle insurance, you can avoid significant financial burdens if you’re involved in an accident or your vehicle is damaged.

Types of Vehicle Insurance

There are several types of vehicle insurance coverage available. Here’s a breakdown of the most common:

- Third-party liability: This is the minimum required coverage in many jurisdictions. It covers damage to other vehicles and injuries to others if you’re at fault in an accident.

- Comprehensive: This coverage protects your vehicle from damage caused by theft, vandalism, natural disasters, and other non-collision events.

- Collision: This covers damage to your vehicle if it’s involved in a collision, regardless of who is at fault.

- Acts of God: This coverage protects your vehicle from damage caused by natural disasters like typhoons, earthquakes, and floods.

- Additional coverages: Some insurers offer additional coverages, such as roadside assistance, rental vehicle reimbursement, and personal accident insurance.

Factors Affecting Vehicle Insurance Premiums

Several factors can influence your vehicle insurance premiums, including:

- Vehicle type: The type of vehicle you own, such as a sedan, SUV, or sports car, will affect your premiums.

- Driving record: A clean driving record with no accidents or traffic violations can result in lower premiums.

- Age and experience: Younger drivers, especially those under 25, may face higher premiums due to their higher risk of accidents.

- Location: Where you live can affect your premiums. Areas with higher accident rates may have higher insurance costs.

- Coverage limits: The amount of coverage you choose will impact your premiums. Higher coverage limits generally result in higher premiums.

- Deductibles: The amount you’re willing to pay out of pocket before your insurance coverage kicks in will affect your premiums. Higher deductibles can lower your premiums.

- Insurance history: Your insurance history, including any claims you’ve filed, can influence your premiums.

Choosing the Right Vehicle Insurance

When selecting vehicle insurance, consider the following factors:

- Coverage needs: Determine the level of coverage you need based on your driving habits, vehicle type, and financial situation.

- Budget: Set a budget for your vehicle insurance premiums.

- Insurance company reputation: Research the reputation of different insurance companies in your area.

- Customer service: Consider the insurer’s reputation for customer service and claims processing.

- Additional benefits: Some insurers offer additional benefits that may be valuable to you, such as roadside assistance or rental vehicle reimbursement.

Claiming Vehicle Insurance

If you’re involved in an accident or your vehicle is damaged, follow these steps to file a claim:

- Contact your insurance company: Notify your insurer as soon as possible.

- Document the incident: Gather information about the accident, including the names and contact information of the other parties involved. Take photos of the damage.

- File a claim: Provide your insurance company with the necessary details and documentation.

- Cooperate with the adjuster: The insurance company will likely send an adjuster to inspect the damage.

- Obtain estimates: Get quotes from repair shops to assess the cost of repairs.

- Negotiate settlement: Review the settlement offer and negotiate if necessary.

Tips for a Smooth Claims Process

- Be prepared: Have your policy information and necessary documentation readily available.

- Be honest: Provide accurate information to your insurance company.

- Be patient: The claims process can take time, so be patient and follow the insurer’s guidelines.

- Seek legal advice: If you’re unsure about the claims process or if you’re dissatisfied with the settlement offer, consider consulting with a lawyer.

Additional Considerations for Vehicle Insurance

- Flood insurance: If you live in a flood-prone area, consider adding flood insurance to your vehicle insurance policy.

- Windstorm insurance: If you live in an area prone to typhoons, windstorm insurance can provide additional protection.

- Earthquake insurance: If you live in an earthquake-prone area, earthquake insurance can help cover damage to your vehicle.

- Vehicle theft: If you live in an area with high rates of vehicle theft, consider increasing your comprehensive coverage.

- Roadside assistance: Roadside assistance can provide valuable services, such as towing, battery jump-starts, and tire changes.

Understanding Your Insurance Policy

It’s crucial to carefully read and understand your vehicle insurance policy. Pay close attention to the following:

- Coverage limits: The maximum amount the insurer will pay for claims.

- Deductibles: The amount you’ll need to pay out of pocket before the insurance coverage kicks in.

- Exclusions: Situations or events that are not covered by the policy.

- Premiums: The cost of the premiums and how they may change over time.

- Customer service: The insurer’s reputation for customer service and claims processing.

- Fine print: Carefully review the fine print for any hidden exclusions or limitations that could affect your coverage.

Tips for Better Policy Review

To ensure you have the best possible vehicle insurance coverage, consider the following tips:

- Compare policies: Get quotes from multiple insurers to compare prices, coverage, and terms.

- Ask questions: Don’t hesitate to ask your insurance agent any questions you have about your policy.

- Review your policy regularly: Review your policy annually to ensure it still meets your needs and that there are no changes that could affect your coverage.

- Consider consulting with an insurance professional: If you’re unsure about the terms and conditions of your policy, consider consulting with an insurance agent or broker.

By following these guidelines and being proactive, you can ensure that you have the right vehicle insurance coverage to protect yourself and your vehicle.

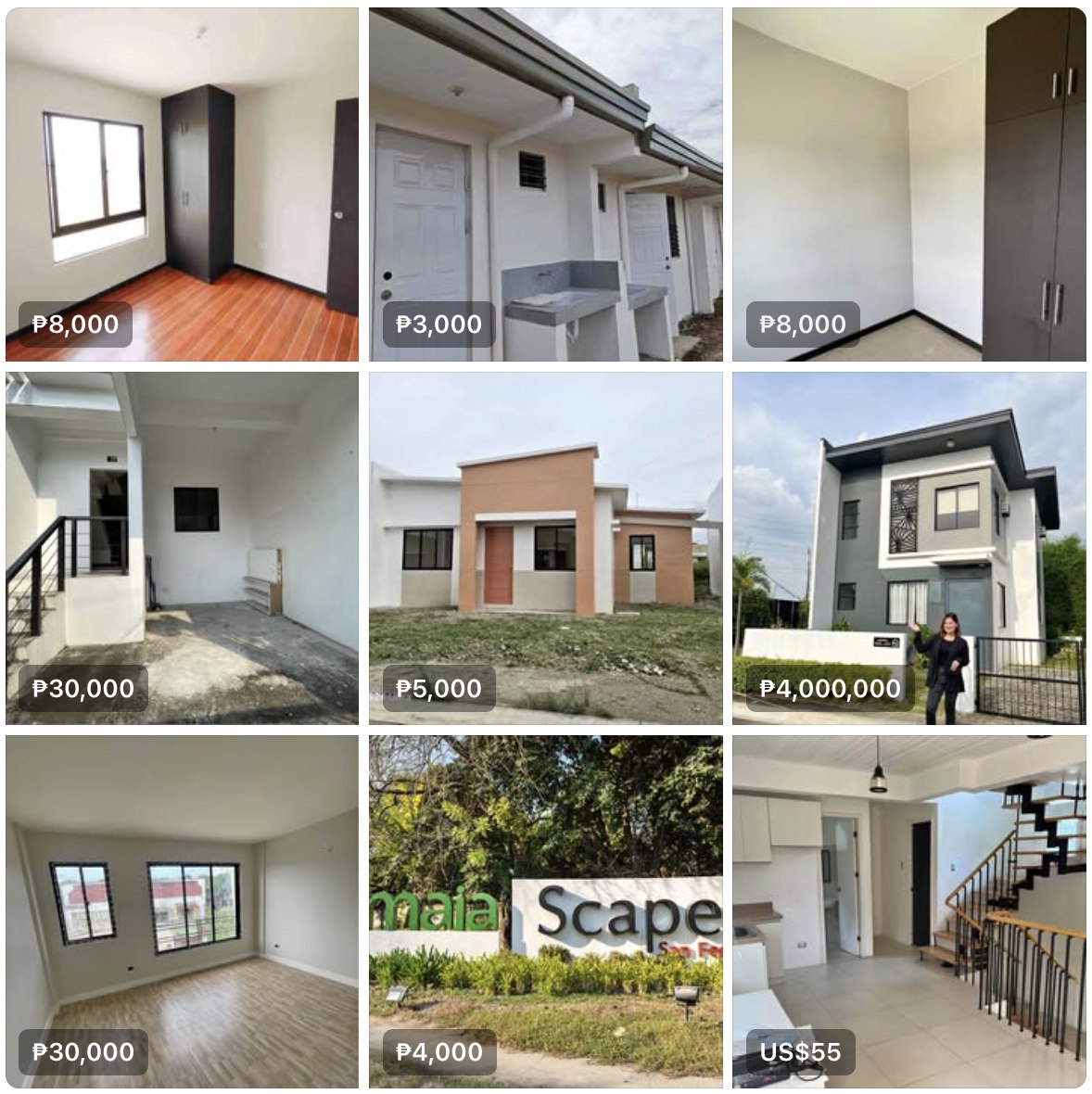

Here’s a list of accredited Insurance companies by Philippine Insurance Commission

For more tips visit this link!