In an era where convenience and accessibility are at the forefront of financial services, online lending apps have emerged as a popular solution for those in need of quick cash. However, amidst the legitimate lenders, there lurks a shadowy underworld of illegal online lending apps that prey on unsuspecting borrowers. These nefarious platforms promise easy money but deliver nothing but trouble, trapping borrowers in a vicious cycle of debt and despair. Here’s what you need to know to protect yourself from the dangers of illegal online lending apps.

The Promise of Easy Money

Illegal online lending apps often lure borrowers with promises of fast and easy money, regardless of credit history or financial situation. They advertise quick approval processes and instant cash disbursement, making them seem like an attractive option for those facing urgent financial needs. However, behind the flashy ads and slick marketing lies a web of deceit and exploitation.

Predatory Practices of Money Lenders

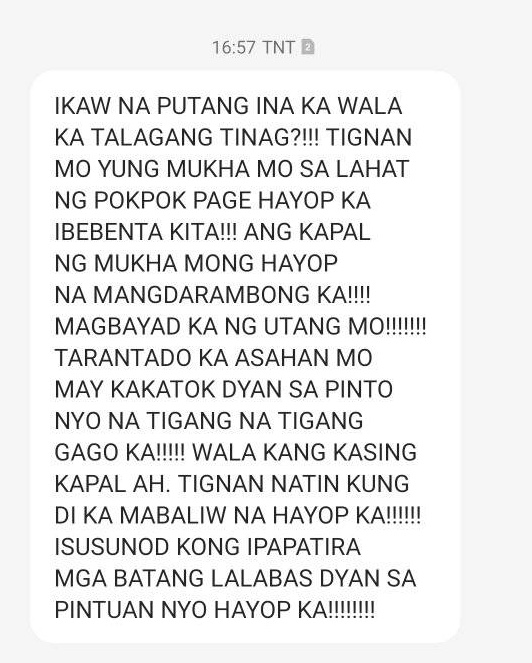

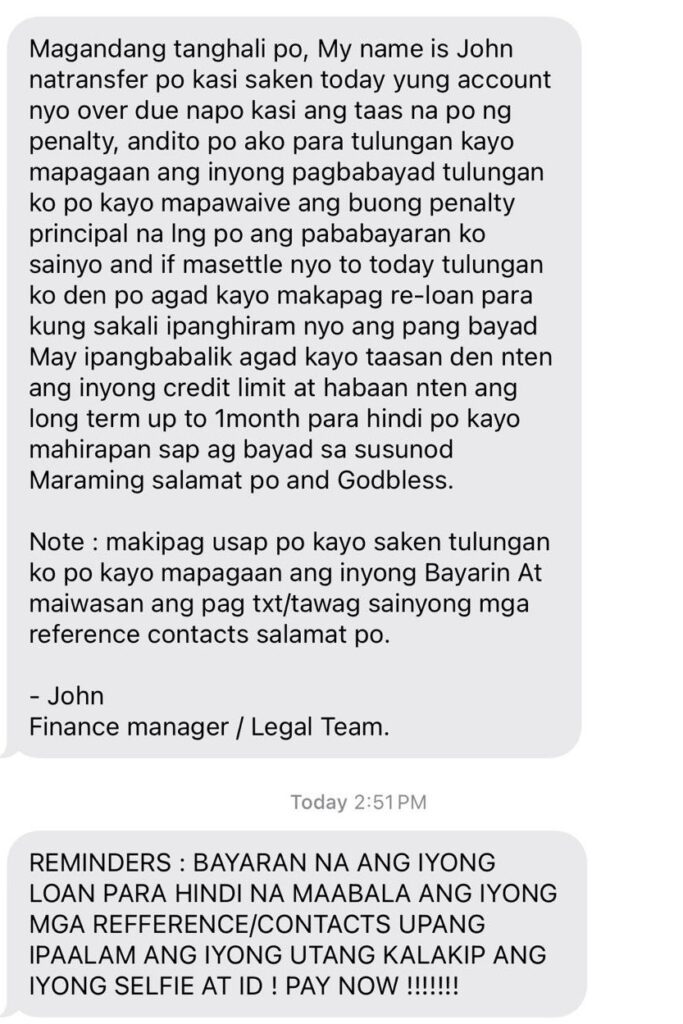

Illegal online lending apps have been found to engage in a range of predatory practices, as uncovered by regulatory investigations. These include excessively high-interest rates, unreasonable terms and conditions, and deceptive claims about charges and fees. Additionally, borrowers have reported serious violations of privacy, with lenders accessing personal information and resorting to abusive collection techniques.

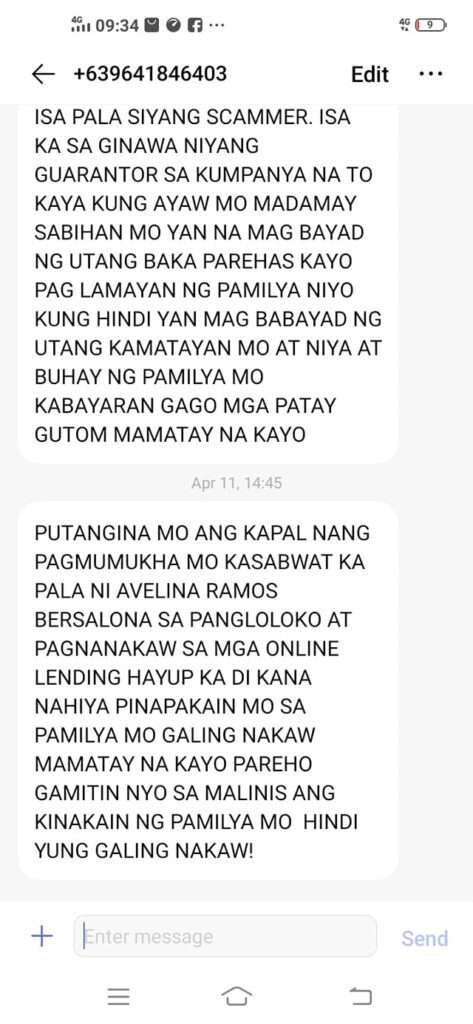

According to the commission, these techniques often involve contacting borrowers’ relatives, friends, and acquaintances and threatening them with public shaming. Furthermore, some lenders have been known to forcibly deposit money into borrowers’ GCash accounts to coerce them into renewing their loans.

These predatory tactics not only violate borrowers’ rights but also exacerbate their financial distress, trapping them in a cycle of debt. It’s crucial for borrowers to remain vigilant and for regulatory authorities to take swift action to protect consumers from such abuses.

Lack of Regulation

One of the most significant dangers of illegal online lending apps is the lack of regulation and oversight. These unscrupulous lenders operate outside the law, evading regulatory authorities and exploiting regulatory loopholes to continue their illicit activities. As a result, borrowers are left vulnerable to abuse and exploitation, with little recourse for recourse or justice.

Peso Go, Instant Pera, QuickPera, Lendmo Philippines, Binixo, CashBus, Cashcat, Cashuttle, Crazy Loan, Flash Cash, Happy2Peso, Hatulong, MeLoan, MoneyTree Quick Loan, Pera Express, Pera4u, Peramart, PesoLending, QuickPeso, and Umbrella.

Personal and Financial Consequences

The consequences of falling victim to illegal online lending apps extend far beyond financial hardship, impacting borrowers’ personal well-being and future financial stability. Borrowers subjected to unfair debt collection practices often experience heightened stress and anxiety, as they face relentless harassment and threats from lenders. These tactics include incessant phone calls, text messages, and emails that border on harassment. Borrowers have reported instances of lenders contacting their relatives, friends, and even employers, disclosing sensitive financial information and threatening legal action or public embarrassment. Moreover, some lenders employ deceptive strategies such as misrepresenting the consequences of non-payment or falsely claiming to have legal authority to seize assets.

The constant pressure and fear instilled by these unfair debt collection practices can take a significant toll on borrowers’ mental health and overall well-being. Additionally, the financial consequences of defaulting on loans from illegal online lending apps can be dire, with borrowers facing penalties, fees, and damage to their credit scores. The cycle of debt perpetuated by these apps can trap borrowers in a downward spiral, making it increasingly difficult to break free and regain financial stability. Such personal and financial consequences underscore the urgent need for regulatory intervention to protect consumers from exploitation and abuse by illegal online lending apps.

While online lending apps can provide a convenient way to access funds quickly, it’s crucial to remain vigilant and cautious when borrowing money online. Illegal online lending apps pose a significant threat to borrowers, exploiting their financial vulnerabilities and trapping them in a cycle of debt. By educating yourself about the dangers of these predatory lenders and taking proactive steps to protect yourself, you can avoid falling victim to their schemes and safeguard your financial well-being.

For reliable and accredited online lending platforms, borrowers are encouraged to refer to the Securities and Exchange Commission’s list of recorded online lending platforms (source: SEC’s official website)

As highlighted in the document from the Philippine Senate (source: Senate of the Philippines), instances of illegal or unfair debt collection practices have been documented, shedding light on the need for regulatory measures to protect borrowers. Additionally, the Securities and Exchange Commission (SEC) provides guidelines on fair debt collection practices in their memorandum circular (source: SEC Memorandum Circular No. 18, Series of 2019), emphasizing the importance of adherence to ethical standards by lending institutions