Receiving a BIR Letter of Authority (LOA) in the Philippines can be intimidating, especially for small business owners. However, understanding the process and knowing how to respond can make it more manageable. Here’s a detailed guide to help you navigate the LOA process confidently.

What is a BIR Letter of Authority (LOA)?

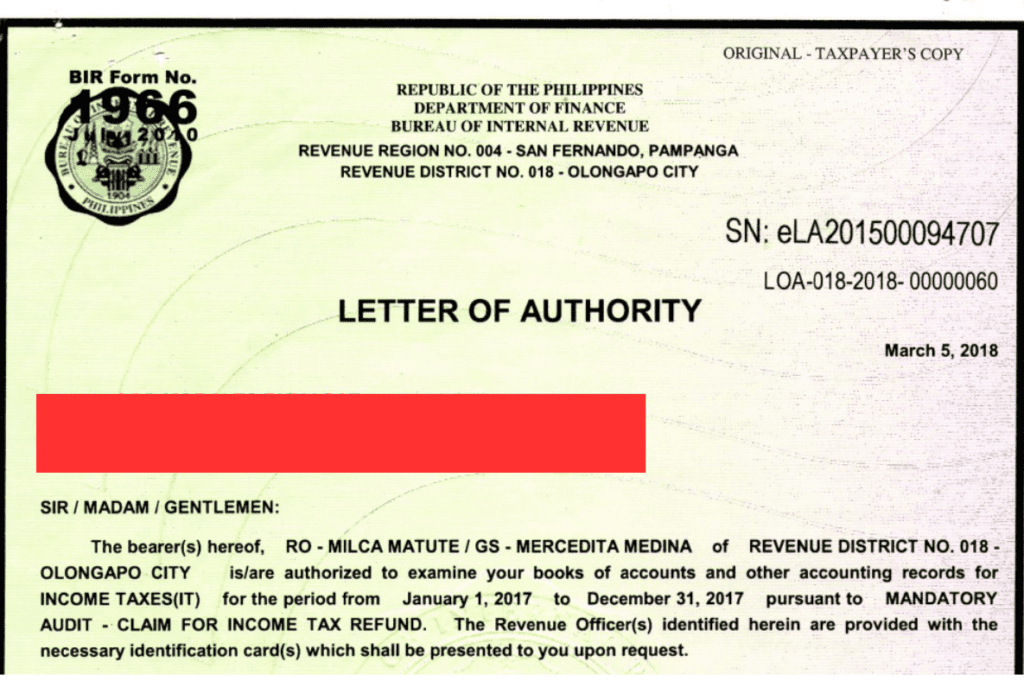

An LOA is a legal document issued by the BIR, granting specific officers the authority to examine and audit your books of accounts, tax returns, and other financial records. It’s not merely a request but a mandate requiring compliance within the specified timeframe.

Step 1: Understand the LOA’s Scope

When you receive a BIR Letter of Authority:

- Read the Details:

- Review the tax types covered (e.g., VAT, income tax, withholding tax).

- Check the periods under audit (e.g., calendar year 2022).

- Confirm Validity:

- Ensure the BIR Letter of Authority is signed by the BIR Regional Director.

- Verify that the revenue officers assigned are authorized to conduct the audit.

- Be Alert for Fraud:

- Contact the BIR office directly to confirm the authenticity of the LOA and the assigned officers.

Step 2: Gather Required Documents

The BIR will ask for specific documents. Prepare these in advance:

Books of Accounts:

- General Ledger

- General Journal

- Sales and Purchase Books

- Cash Disbursement and Receipts Books

Tax Returns:

- Income Tax Returns (ITR)

- Value-Added Tax (VAT) or Percentage Tax Returns

- Withholding Tax Returns

- Other relevant tax filings

Supporting Documents:

- Sales invoices and official receipts

- Purchase invoices and expense receipts

- Bank statements and reconciliations

- Payroll records (if applicable)

- Contracts, agreements, and lease documents

Organize these documents chronologically and label them for easy reference.

Step 3: Conduct an Internal Review

Before submitting any records:

- Reconcile Your Books:

- Ensure reported sales match your invoices.

- Check if tax payments align with your tax liabilities.

- Compare bank statements with recorded transactions.

- Spot Potential Issues:

- Identify discrepancies, such as unrecorded income or mismatched receipts.

- Address any missing or incomplete records.

- Prepare Explanations:

- Be ready to explain unusual transactions or adjustments.

Step 4: Respond Promptly to the LOA

The BIR Letter of Authority will specify a deadline for submitting documents. Here’s how to respond:

- Submit Documents on Time:

- Avoid delays to prevent penalties or further scrutiny.

- Be Transparent:

- Do not withhold or alter records. Falsifying documents can lead to severe penalties or legal action.

- Keep Copies:

- Retain duplicates of all submitted documents for your reference.

Step 5: Seek Professional Assistance

Tax audits can be complex, so it’s wise to get expert help:

- Hire a CPA or Tax Consultant:

- They can guide you through the audit process and address technical tax issues.

- Authorize a Representative:

- If you’re unavailable, appoint a representative through a notarized Special Power of Attorney (SPA) to handle the audit on your behalf.

Step 6: Cooperate During the Audit

During the audit, BIR officers may request explanations or additional documents. Here’s how to handle this stage:

- Be Professional:

- Communicate respectfully and avoid unnecessary conflicts.

- Provide Accurate Information:

- Stick to the facts when answering questions.

- Document Interactions:

- Keep a record of all communications, including meetings and correspondence.

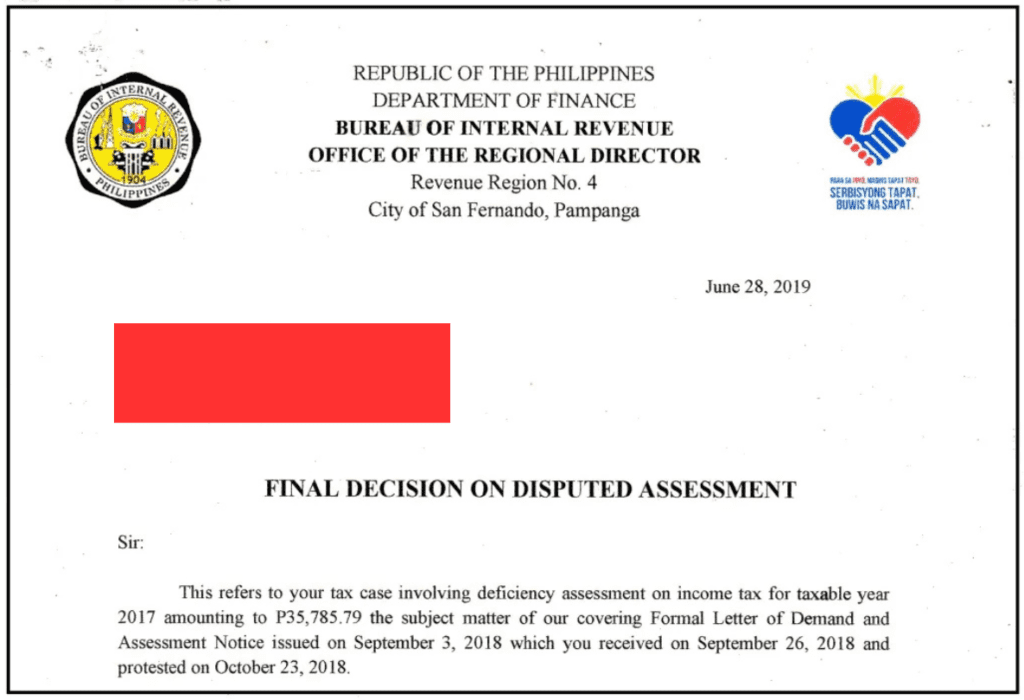

Step 7: Address Assessment Findings

After the audit, the BIR will issue an assessment:

- Preliminary Assessment Notice (PAN):

- If discrepancies are found, you’ll receive a PAN.

- You have 15 days to respond and explain or contest the findings.

- Final Assessment Notice (FAN):

- If unresolved, a FAN follows, detailing your tax liabilities.

- You can:

- Protest: File a formal protest with supporting evidence.

- Appeal: Bring the case to the Court of Tax Appeals (CTA) within 30 days if you disagree.

- Settlement Options:

- Negotiate for a compromise settlement if eligible.

- Pay the assessment if it’s accurate and agreed upon.

Step 8: Learn and Improve Compliance

Use the audit as an opportunity to strengthen your tax practices:

- Enhance Record-Keeping:

- Maintain organized and accurate records of all transactions.

- Timely Filing and Payment:

- File your tax returns and pay taxes promptly to avoid future audits.

- Regular Internal Audits:

- Periodically review your books to ensure they are audit-ready.

Common Pitfalls to Avoid

- Ignoring the LOA:

- Failure to respond can escalate the situation.

- Inadequate Preparation:

- Missing or disorganized records can raise red flags.

- Overlooking Expert Help:

- Handling an audit without professional guidance can lead to costly mistakes.

FAQ: Frequently Asked Questions

| Question | Answer |

|---|---|

| What is an LOA, and why did I receive it? | An LOA is a mandate from the BIR authorizing them to audit your taxes. It ensures compliance with tax laws. |

| What should I do if I can’t find some records? | Inform the BIR promptly and provide a written explanation. Try to reconstruct missing records as accurately as possible. |

| How long does a BIR audit take? | The duration varies but is typically completed within the validity period of the LOA, which is usually one year. |

| Can I negotiate with the BIR during an audit? | Yes, you can explain your position, provide supporting documents, and even negotiate for a compromise settlement if applicable. |

| What happens if I ignore the LOA? | Ignoring an LOA can result in penalties, increased scrutiny, or even legal action. Always respond promptly. |

An LOA from the BIR doesn’t have to be a source of stress. By understanding the process, preparing thoroughly, and seeking professional assistance when needed, you can handle the audit effectively. Compliance is key to ensuring your business continues to operate smoothly and avoids future issues with the BIR.

For more check out this page!