Bureau of Customs clearance with Import and Assesment Service (IAS)

For international businesses, navigating the labyrinth of customs clearance can feel like deciphering an ancient riddle. One particularly persistent challenge lies in the discrepancies between the declared value of imported goods and the valuation assigned by the Bureau of Customs’ Imports Assessment Service (IAS). This discrepancy often arises even when bank transfers offer seemingly irrefutable proof of the actual transaction cost. This persistent issue raises a specter of disquiet: is the current system susceptible to manipulation, fostering a culture of “under the table” transactions?

The current customs valuation system relies heavily on physical documentation and reference values. This creates a system with inherent vulnerabilities. Invoices can be manipulated – product specifications can be altered, discounts fabricated, or additional charges invented. Reference values, meant to establish a baseline for fair valuation, often struggle to keep pace with the dynamic nature of global markets. This opacity opens the door to subjective interpretations, some of which could be influenced by external factors. The ever-present suspicion of undervaluation, where importers deliberately declare a lower value to minimize customs duties, often leads to inflated valuations by the IAS, even when bank transfers paint a picture of a legitimate transaction.

This lack of transparency fosters an environment conducive to corrupt practices. Businesses seeking a smoother clearance process might be tempted to resort to “greasing the wheels,” gaining an unfair advantage over those who choose to navigate the system by the book. This not only undermines legitimate businesses but also hinders economic growth by creating an uneven playing field. The potential for manipulation discourages honest businesses from participating in international trade, ultimately harming the overall economic health of a nation.

The answer to this valuation enigma lies not in clinging to outdated methods, but in embracing the transformative power of the digital age. Streamlining customs procedures with robust digital platforms could revolutionize the import clearance process. Imagine a system where invoices are electronically verified against bank transfers, creating an auditable trail that removes any room for manipulation of transaction details. Additionally, integrating real-time market data into the IAS system would ensure valuations are based on current market trends, not outdated benchmarks. This would eliminate discrepancies arising from reliance on potentially outdated reference values.

Furthermore, fostering cross-country cooperation through information sharing could be a powerful weapon against undervaluation. Imagine a world where customs agencies collaborate, sharing data on declared values, transaction details, and market trends. This collaborative approach would create a global information web, making it significantly harder for unscrupulous actors to exploit loopholes in individual systems. If a particular import shows a suspicious discrepancy between declared value and past transactions involving the same product from the same source country, a red flag would be raised, prompting further investigation. This collaborative effort would not only deter intentional undervaluation but also create a more uniform valuation framework across borders.

The benefits of embracing digitalization and international cooperation extend beyond just tackling valuation discrepancies. A digital platform could expedite the entire customs clearance process, reducing delays and associated costs for businesses. Additionally, collaboration among customs agencies could lead to the standardization of documentation and procedures, further streamlining international trade.

However, the path towards a transparent and efficient customs clearance process is not without its challenges. Implementing robust digital platforms requires significant investment in infrastructure and technology. Additionally, fostering international cooperation necessitates overcoming data privacy concerns and establishing trust between countries.

Despite these challenges, the potential benefits of a digital, collaborative approach are too significant to ignore. By dismantling the murky maze of customs valuation, we can create a fairer playing field for international businesses, reduce the temptation for corruption, and ultimately pave the way for a more robust and transparent global trade ecosystem. The time to act is now. Let us embrace the digital revolution and build a future where international trade thrives not on manipulation, but on transparency and cooperation.

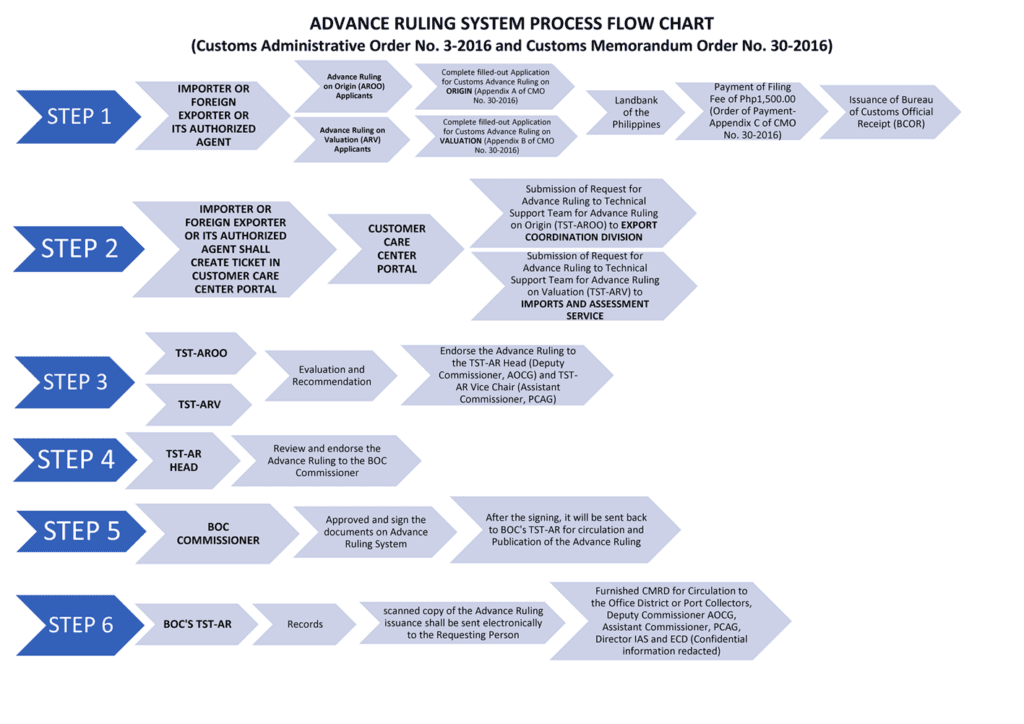

Here’s a reference to the Memorandum on Custom’s Clearance being implemented today. (click here)

Page 13 of this Study Points to how an assesment will be made by the IAS when verifying values of the cargo (click here)