In a significant move to modernize its tax system and ensure equitable taxation, the Philippine Bureau of Internal Revenue (BIR) has enacted Republic Act No. 12023, imposing a 12% Value-Added Tax (VAT) on digital services provided by non-resident digital service providers (DSPs) to Filipino consumers. Signed into law by President Ferdinand Marcos Jr. on October 2, 2024, this legislation aims to level the playing field between local and foreign digital service providers.

Scope of VAT on Digital Services

The new VAT applies to a broad range of digital services consumed in the Philippines, including:

- Streaming platforms (e.g., Netflix, Spotify, Disney+, Amazon Prime Video)

- Online marketplaces and e-commerce platforms (e.g., Amazon, Shein)

- Cloud computing and storage services (e.g., Google Cloud, AWS, Dropbox)

- Digital advertising services (e.g., Google Ads, Facebook Ads)

- Software and app purchases (e.g., Microsoft 365, Adobe Creative Cloud)

- E-books, online subscriptions, and digital content sales

- Online learning platforms (e.g., Coursera, Udemy, Skillshare)

- Gaming platforms (e.g., Steam, Epic Games Store, PlayStation Store)

Notably, educational services provided by institutions accredited by the Department of Education (DepEd), Commission on Higher Education (CHED), and Technical Education and Skills Development Authority (TESDA) are exempt from VAT on digital Services.

Implementation Timeline

The Bureau of Internal Revenue (BIR) has outlined the following timeline for implementation:Global VAT Compliance+1Taxumo+1

- January 17, 2025: Release of Revenue Regulations No. 3-2025, detailing the VAT application on digital services.Wikipedia+2Taxumo+2Global VAT Compliance+2

- April 25, 2025: Amendments introduced via Revenue Regulations No. 14-2025, extending registration deadlines for non-resident DSPs.Taxumo

- June 1, 2025: Deadline for non-resident DSPs to register with the BIR through the Virtual Digital Service (VDS) Portal.Taxumo+1UNBOX PH+1

- June 2, 2025: Commencement of VAT collection and remittance by registered DSPs. Taxumo+1UNBOX PH+1

Impact on Subscription Costs

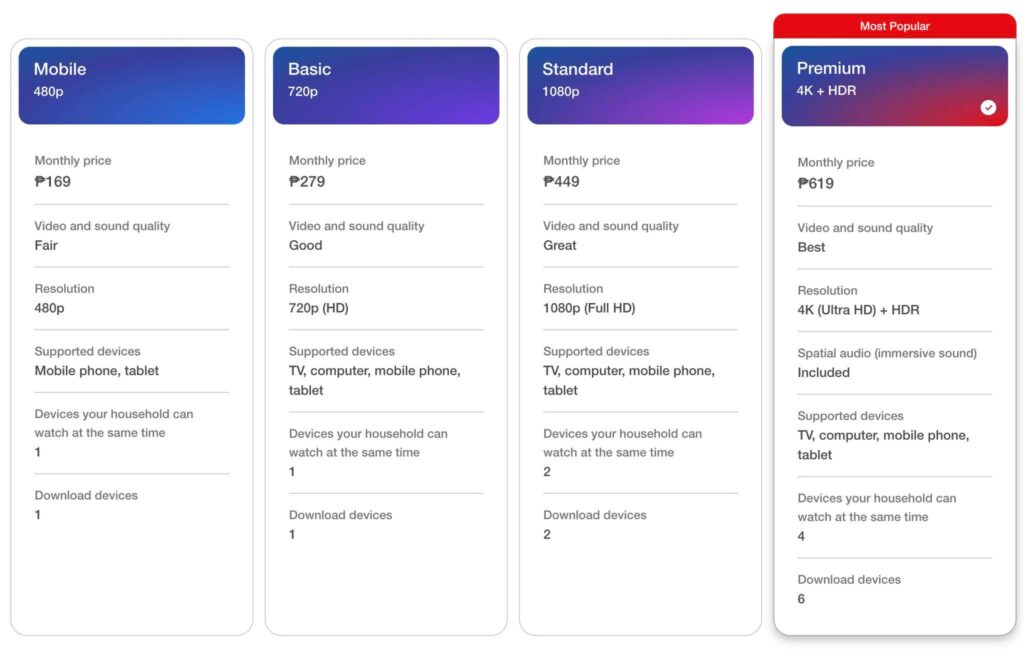

The imposition of the 12% VAT is expected to lead to price adjustments across various digital platforms. For instance, Netflix has announced the following changes effective June 1, 2025:

Other platforms such as Disney+, Amazon Prime Video, and Spotify are anticipated to implement similar price adjustments to accommodate the new tax, although specific figures have yet to be disclosed.

VAT on Digital Services Applicability

| Platform | Service Type | VAT Applied? | Notes |

|---|---|---|---|

| Netflix, Disney+ | Streaming | ✅ Yes | VAT added to monthly fee |

| Spotify | Music Streaming | ✅ Yes | Standard 12% VAT for Digital Services applies |

| Lazada, Shopee | E-commerce / Marketplace | ✅ Yes | For platform fees or services sold |

| Upwork, Fiverr | Freelance Services | ✅ Conditional | VAT if client is in PH. Freelancers w/ foreign clients = VAT zero-rated |

| Google Ads, FB Ads | Digital Ads | ✅ Yes | Applies to ad spend billed to PH clients |

| AWS, Google Cloud | Cloud Services | ✅ Yes | Subject to VAT for PH-based usage |

| Coursera, Udemy (Accredited) | Online Education | ❌ No | Exempt if DepEd/CHED/TESDA-accredited |

| Online Banking Apps | Financial Services | ❌ No | Exempt under financial services rule |

Compliance Requirements for DSPs

Under the new regulations, non-resident DSPs earning over ₱3 million annually from Philippine consumers are mandated to:Global VAT Compliance

- Register with the BIR through the VDS Portal.

- Appoint a local representative to manage tax obligations.

- Collect and remit the 12% VAT on gross receipts from digital transactions.

- Issue invoices or receipts displaying the VAT separately.

Failure to comply may result in penalties, including the suspension of operations within the Philippines.

Revenue Projections and Allocation

The Department of Finance projects that the implementation of the digital VAT will generate approximately ₱105 billion in revenue over the next five years, with an estimated ₱7.25 billion expected in 2025, assuming a 50% compliance rate.

Significantly, 5% of the revenue collected under RA 12023 will be allocated to support the local creative industry, aiming to foster innovation and empower Filipino artists, musicians, and filmmakers.

The introduction of a 12% VAT on digital services marks a pivotal step in the Philippines’ efforts to modernize its tax system and ensure fair competition between local and foreign service providers. While consumers may experience slight increases in subscription costs, the long-term benefits include enhanced revenue for public services and support for the nation’s creative industries.

FAQ: VAT for Digital Services Law in the Philippines

| Question | Answer |

|---|---|

| 1. What is the VAT for Digital Services Law? | Republic Act No. 12023 imposes a 12% VAT on digital services consumed in the Philippines. It applies to both local and foreign providers to ensure fair competition. |

| 2. Who is covered by this law? | The law applies to digital service providers operating in the Philippines, including: • Streaming platforms (Netflix, Disney+, Spotify) • Online marketplaces (Shopee, Lazada) • Cloud services (Google Cloud, AWS) • Digital advertising platforms (Meta Ads, Google Ads) • Freelance platforms (Upwork, Fiverr, Freelancer.com) |

| 3. How are freelance platforms like Upwork and Fiverr affected? | • VAT applies to service fees if a Filipino client hires a freelancer through these platforms. • Filipino freelancers serving foreign clients are not charged VAT, as it’s considered a zero-rated export. • Freelancers must register with the BIR if gross receipts exceed ₱3 million annually and keep documentation. |

| 4. Does VAT apply to Philippine companies serving global clients? | No. Digital services provided to clients outside the Philippines are generally zero-rated and not subject to the 12% VAT. |

| 5. What digital services are exempt from the 12% VAT? | • Educational services from DepEd-, CHED-, or TESDA-accredited institutions • Digital financial services (e.g., online banking, digital payments) • Academic subscriptions purchased by accredited schools |

| 6. What must affected companies do to comply? | • Register with the BIR if gross sales exceed ₱3 million/year • Foreign firms must appoint a local VAT representative • Charge 12% VAT on qualifying services • File VAT returns monthly or quarterly • Maintain records separating domestic and export transactions |

| 7. What happens if companies don’t comply? | Non-compliance may result in: • Monetary fines and legal penalties • Interest on unpaid taxes • Suspension or blocking of platform access in the Philippines |

| 8. How does this law affect Filipino consumers? | Consumers can expect price increases for digital services due to VAT: • Streaming subscriptions • Online purchases and ads • Hiring freelancers on gig platforms • Educational and banking digital services remain VAT-free |

| 9. Where will the VAT revenue go? | • The government expects to collect ₱105 billion over five years • Most funds will go to infrastructure and digitalization projects • 5% will support Filipino creatives (artists, musicians, filmmakers) |

| 10. When did the VAT law take effect? | The law was passed in 2024, and enforcement began in 2025. BIR is now requiring registration, tax collection, and filing by covered platforms |

Sources:

For similar articles, check out this link!