Text message scams have become one of the most common forms of fraud worldwide, and Filipinos are increasingly being targeted by these deceptive schemes. Often referred to as “smishing” (SMS phishing), these scams use fraudulent text messages to trick individuals into providing sensitive information, such as personal details, passwords, and financial information. With the implementation of the SIM Card Registration Act in the Philippines, scammers are now taking advantage of this process to further exploit unsuspecting mobile users.

What are Text Message Scams?

Text message scams involve fraudsters sending deceptive messages that appear to be from legitimate companies, government agencies, or even personal contacts. These messages often create a sense of urgency, asking the recipient to take immediate action, such as clicking on a link, updating their account information, or registering their SIM card to avoid service disconnection. Once victims interact with the message, scammers can steal sensitive data or install malware on the victim’s device.

Common Types of Text Message Scams in the Philippines

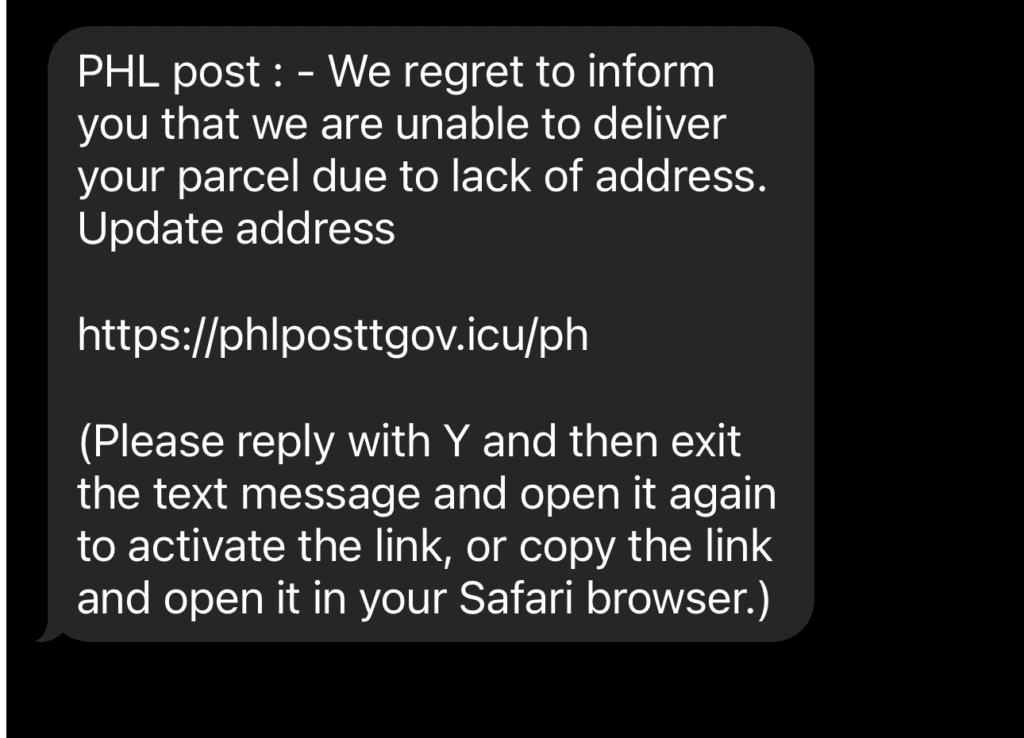

- SIM Card Registration Scams: Scammers send messages pretending to be from telecom providers, urging recipients to register their SIM cards or face service termination. These texts direct users to fake websites where their personal data is harvested.

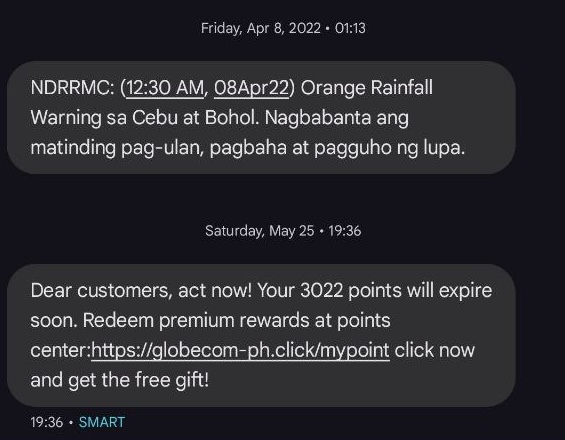

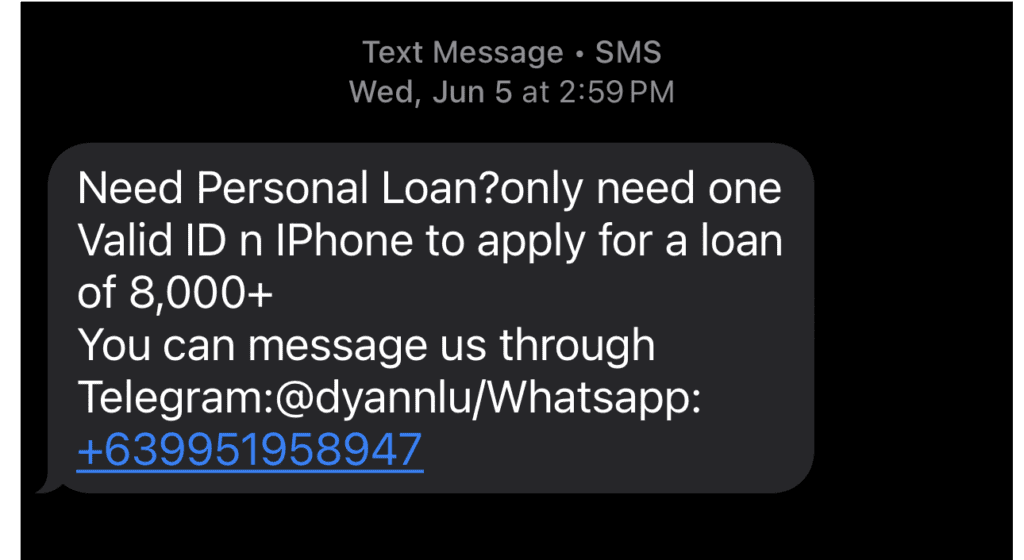

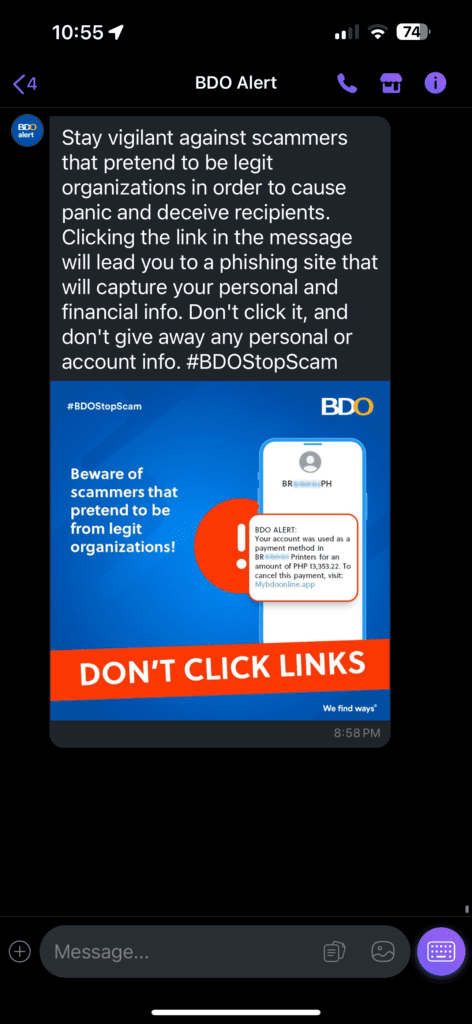

- Phishing (Smishing): Fraudsters pose as banks, telecom companies, or government agencies, asking users to click on malicious links or provide personal details. Victims believe they’re engaging with legitimate services, but instead, they’re giving scammers access to sensitive data.

- OTP (One-Time Password) Theft: Scammers send text messages that trick users into sharing their OTPs. These passwords are often used for logging into bank accounts or completing financial transactions, and once shared, scammers can gain unauthorized access.

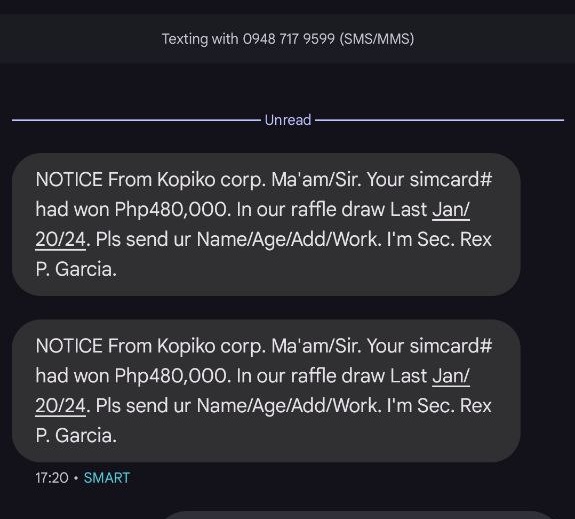

- Fake Prize and Lottery Scams: These scams inform the recipient that they’ve won a prize or lottery, but in order to claim it, they must pay a fee or provide bank details. Victims either lose their money or have their personal information stolen.

- Impersonation Scams: Fraudsters pretend to be family members, friends, or coworkers in urgent situations. They send messages asking for money, claiming they need help due to an emergency or financial problem.

Tactics Used by Text Message Scammers

- Urgency and Fear: Many scams are designed to create panic. They often threaten service disconnection, account closure, or financial penalties if immediate action isn’t taken.

- Official-Sounding Messages: Scammers use language that mimics official communications from companies or government bodies. This includes using logos, formal language, and fake URLs that look legitimate.

- Links to Malicious Websites: Scammers include links that appear trustworthy but lead to fraudulent sites where victims unknowingly provide their personal information or download malware.

How to Protect Yourself from Text Message Scams

- Avoid Clicking on Links: If you receive a message asking you to take urgent action, never click on links in the message. Instead, visit the official website or contact the company directly to verify the message’s authenticity.

- Don’t Share Personal Information: Legitimate companies will never ask for sensitive information, such as passwords or OTPs, via text message. Be cautious and never provide personal data through SMS.

- Verify the Source: If you’re unsure about the legitimacy of a text, contact the sender through official channels before taking any action. Avoid responding to suspicious messages directly.

- Enable Spam Filters: Most smartphones have built-in tools to filter spam messages. You can also block numbers that repeatedly send suspicious texts.

- Report the Scam: If you receive a suspicious text message, report it to your telecom provider or the National Telecommunications Commission (NTC) in the Philippines to help track and block fraudulent activity.

What to Do If You’ve Fallen Victim to a Text Message Scam

- Contact Your Bank or Telecom Provider: If you’ve shared personal or financial information, immediately contact your bank or telecom provider to report the incident and secure your accounts.

- Change Your Passwords: Update your passwords for any accounts that may have been compromised, especially if you shared login credentials or received an OTP message.

- Monitor Your Accounts: Keep a close eye on your bank, email, and social media accounts for any unauthorized activity. Report any suspicious transactions or changes immediately.

- Report the Scam: Notify the relevant authorities, including your telecom provider and the NTC, about the scam to help prevent others from being targeted.

Text message scams are on the rise, and fraudsters are constantly developing new ways to deceive victims, from SIM card registration fraud to OTP theft. By staying vigilant and learning to recognize the warning signs of SMS phishing, Filipinos can protect themselves from falling victim to these scams. Always verify the source of any unexpected text messages, avoid clicking on suspicious links, and never share personal information through SMS.

Here are a couple of articles to help you know more about the sim registration act and its initial results