The digital marketplace offers Filipinos a vast sea of opportunities to showcase their talents and generate online income. This dynamic environment, shaped by technological advancements and regulatory shifts, has given rise to a new economy accompanied by regulatory measures. One such recent development in the Philippines is the introduction of the 1% withholding tax on online sellers, a pivotal change impacting numerous businesses and entrepreneurs reliant on digital platforms for their products and services. Comprehending this regulation transcends mere compliance; it signifies adaptation to a digital commerce era where transparency and equity are paramount.

In essence, the 1% withholding tax acts as a crucial element within the broader tax framework. It resembles a new rule in a board game, altering players’ strategic approaches. Previously, the tax system primarily covered transactions between clients and suppliers. With the advent of the “1% tax on online sellers,” the system expands its reach, encompassing more participants and ensuring everyone contributes proportionately.

For the average online seller, especially those engaged in small-scale enterprises like selling handmade crafts, this introduces a new dimension to their financial considerations. Previously focused on income tax and, if applicable, VAT for higher turnovers, sellers must now factor in the implications of the “1% withholding tax.”

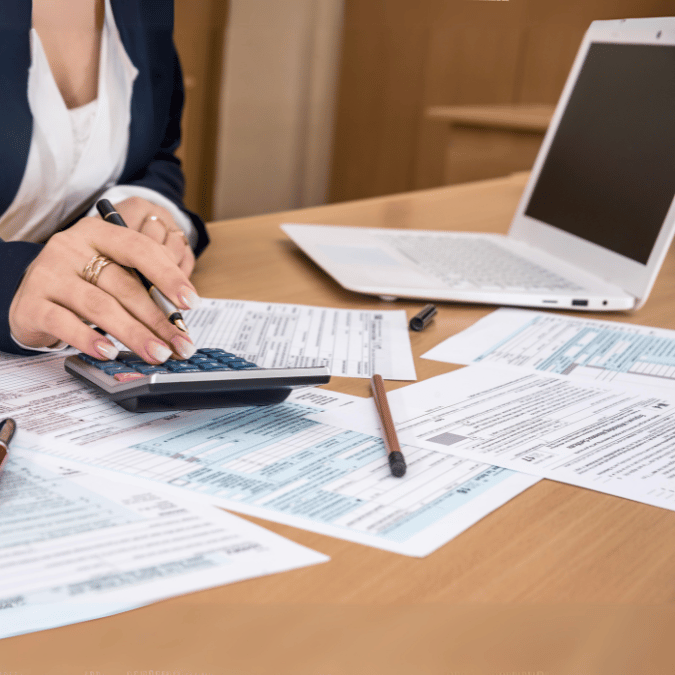

To elucidate, the “1% withholding tax” represents a fraction of each sale that the government collects upfront, akin to a restaurant deducting a portion of a waiter’s daily earnings for future tax obligations. Rather than an additional burden, this tax serves as a prepayment, offsetting the seller’s income tax liabilities at the end of the fiscal year. Every transaction on online marketplaces triggers a 1% withholding, subsequently remitted to the Bureau of Internal Revenue (BIR) by the platform.

For online sellers, this new tax paradigm streamlines tax calculations, providing a proactive approach to managing tax obligations. Instead of facing a substantial year-end tax bill, a fraction is automatically set aside with each sale, comparable to depositing a portion of earnings into a savings account for future expenses.

This system also fosters fairness by spreading the tax compliance responsibility more evenly. Previously, diligent and registered taxpayers bore the brunt, but with the “1% tax on online sellers,” even those previously unnoticed contribute their equitable share. It creates a communal analogy where everyone contributes, akin to a potluck dinner evolving from a few contributors to a more inclusive and equitable event.

Beyond easing tax payments for sellers, the new tax regime provides the Bureau of Internal Revenue (BIR) with enhanced visibility into the e-commerce landscape. Analogous to having a guest list for a party, this visibility aids in understanding the size and dynamics of the Philippines’ burgeoning e-commerce sector, valued at $16 billion in 2023.

Considering the substantial size of the e-commerce market, the “1% withholding tax” contributes significantly to government revenue. This revenue, derived from even a small percentage of the $16 billion market, can be reinvested in public services and infrastructure, benefiting society at large.

The introduction of the “1% withholding tax” transforms the e-commerce game in the Philippines. It levels the playing field, ensuring that all players, regardless of size, contribute to the nation’s economy. This move is not solely about increasing tax revenue; it aims to create a more organized and regulated online marketplace. The small fraction withheld from each sale collectively forms a substantial revenue stream for the country.

Adapting to this new tax regulation requires online sellers to comprehend the process, accurately report sales, and ensure taxes are appropriately withheld. Online marketplaces play a pivotal role as intermediaries, managing the withholding and remittance of taxes to the BIR, akin to marketplace organizers collecting fees for market upkeep.

The operational process introduced by the “1% withholding tax” involves online marketplaces withholding 1% of each transaction and reporting these withholdings to the BIR. For sellers, the withheld amount serves as a prepayment towards their income tax, which can be used as a tax credit when filing quarterly income taxes. Sellers also bear the responsibility of submitting a detailed Summary Alphalist of Withheld Taxes along with their quarterly income tax filings, akin to a traveler maintaining receipts for expense reimbursements.

While adapting to these new requirements may seem challenging initially, using tools like Taxumo designed for online sellers can simplify the process. Similar to a smart home system managing various devices, these tools streamline tracking sales, calculating taxes, and preparing necessary reports, allowing sellers to focus on growing their businesses.

Looking forward, the future of online selling and taxation in the Philippines will likely witness further evolution as the e-commerce industry continues to burgeon. Staying informed and adaptable is crucial for online sellers, akin to staying abreast of updates in favorite apps to enhance functionality and meet changing user needs.

In conclusion, the “1% withholding tax” on online sellers signifies a substantial stride in modernizing the tax system for the booming digital economy in the Philippines. Beyond simplifying tax compliance, it promotes fairness and provides the government with a more accurate understanding of the e-commerce landscape. Online sellers must comprehend and adapt to these changes, embracing new rules that promise a more equitable and transparent marketplace. As the e-commerce sector evolves, embracing change, staying informed, and remaining adaptable are key to thriving in the dynamic world of online selling. The “1% withholding tax” is not just a tax policy; it’s a step towards creating a more organized, fair, and prosperous digital marketplace for all participants.