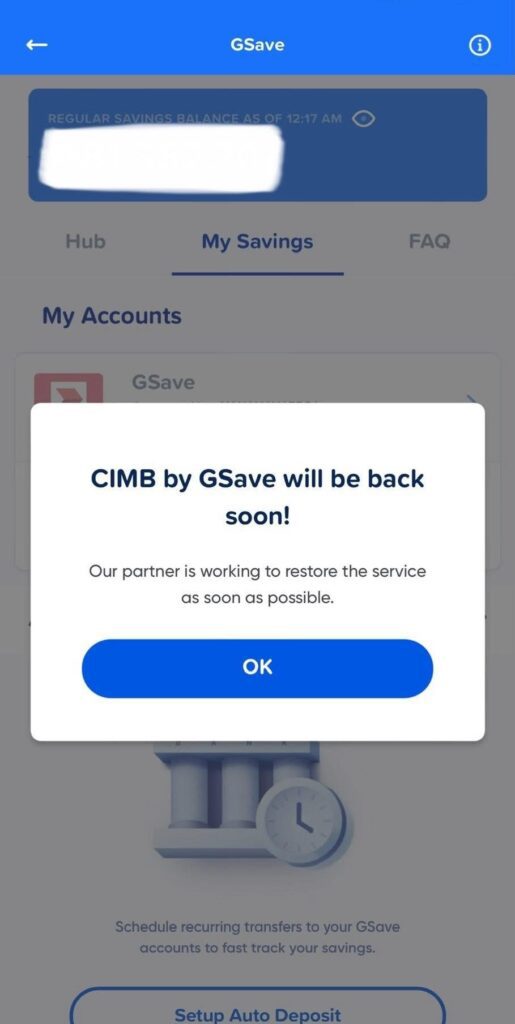

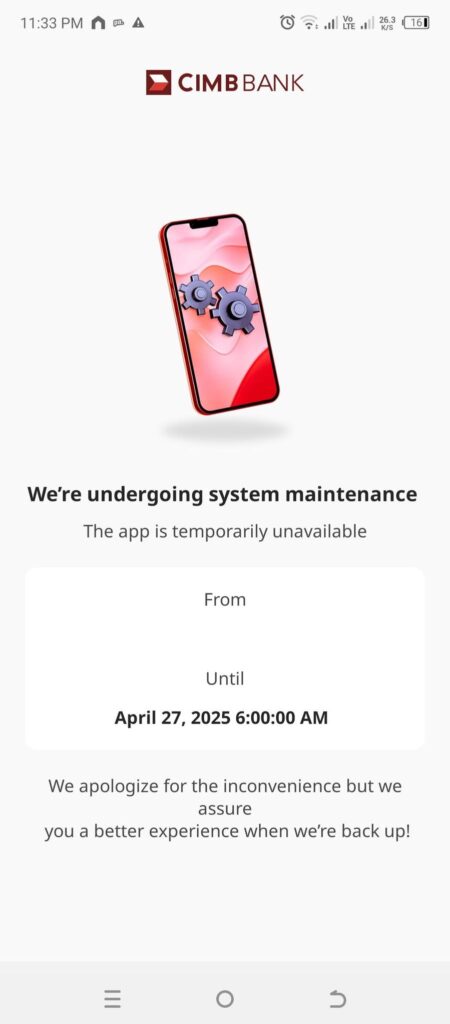

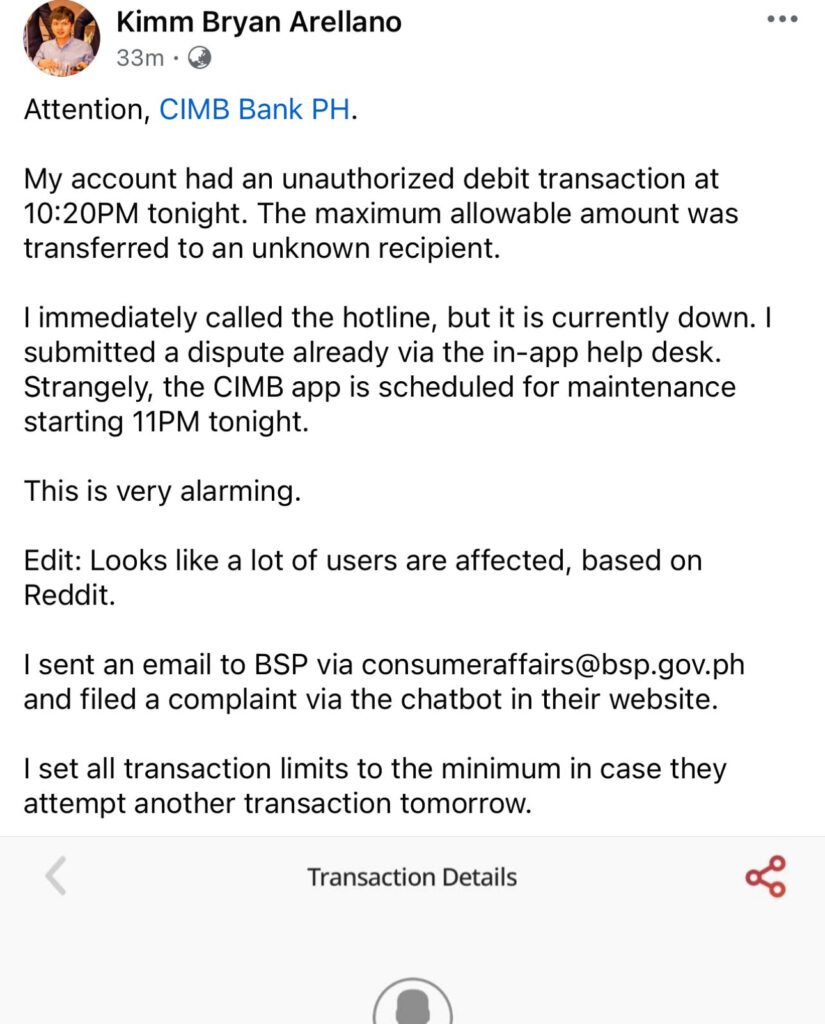

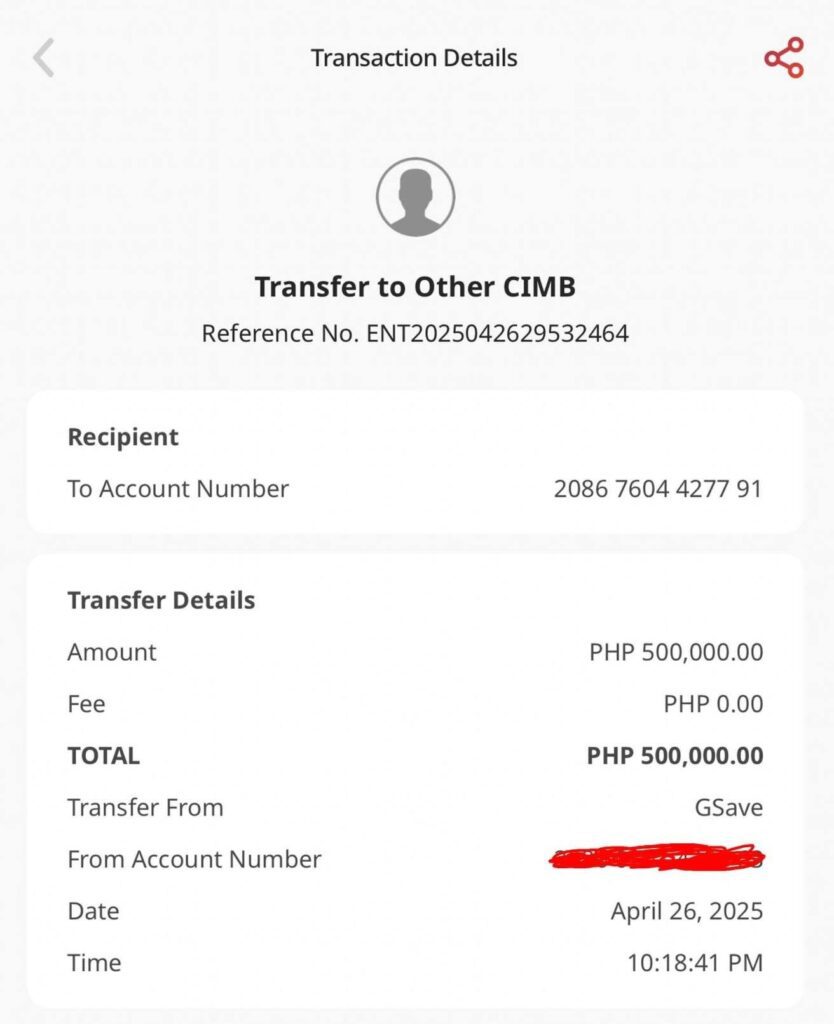

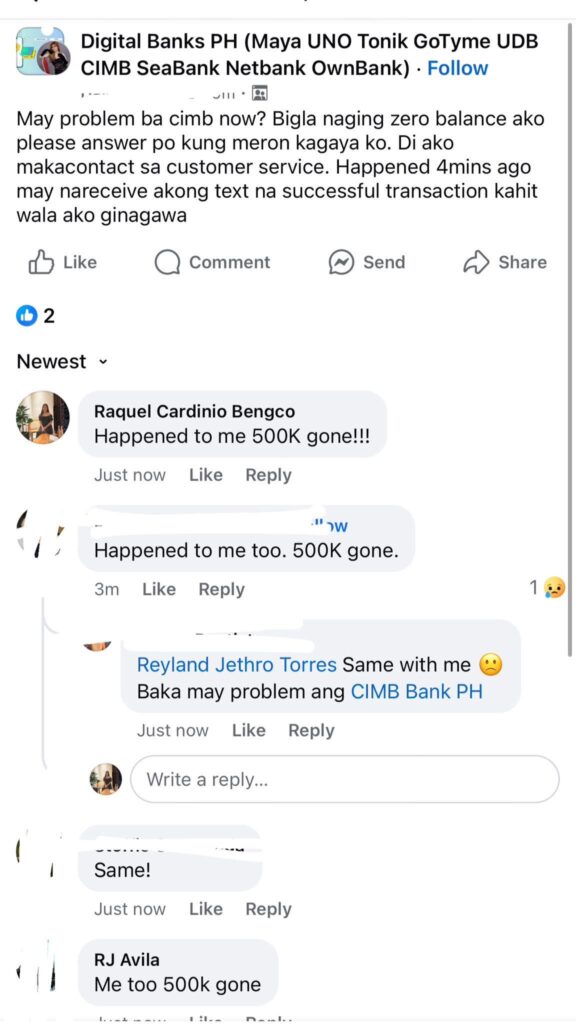

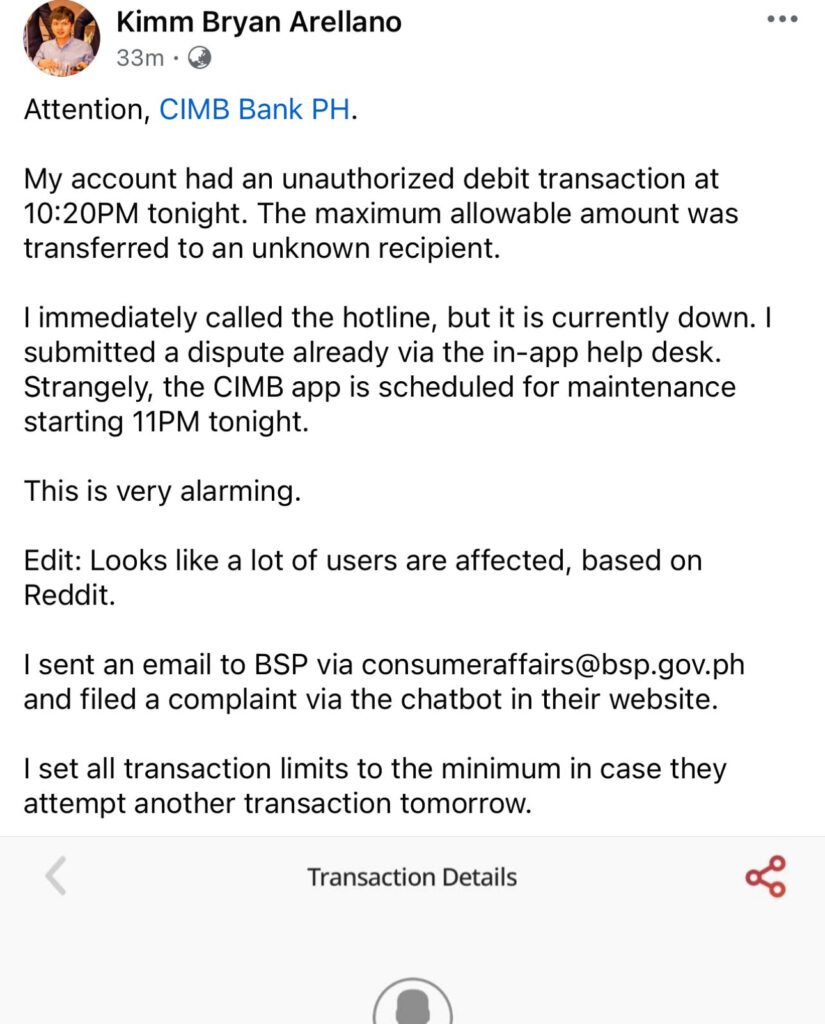

In a shocking turn of events, numerous CIMB Bank account holders are reporting sudden, unauthorized withdrawals from their accounts, with losses ranging from ₱50,000 to a staggering ₱500,000. As panic sweeps across affected customers, many are finding it impossible to reach the bank’s customer support due to a simultaneous system and hotline outage.

What’s Happening with CIMB Bank?

Early reports flooded social media, detailing cases where customers woke up to discover that large amounts of money had vanished from their CIMB accounts. These were unauthorized transactions — swift, large, and without prior notification to account holders.

Even more concerning, many who tried to contact CIMB’s customer support were met with busy signals, unresponsive chatbots, or complete silence. As of now, the bank has yet to release a formal statement addressing the widespread incident.

How Serious is the Situation?

Very serious. For many individuals, these accounts held life savings, emergency funds, or critical business capital. With amounts of ₱50,000 to ₱500,000 disappearing in an instant, the emotional and financial toll is severe. Panic is understandable — but quick action is crucial.

While the situation is still unfolding, it’s important to note that deposits in banks like CIMB are insured up to ₱1 million pesos by the Philippine Deposit Insurance Corporation (PDIC). This means that even in worst-case scenarios, customers are protected up to that amount. However, regaining access to your money can take time depending on the investigation.

What to Do If You’re Affected

1. Document Everything Immediately:

Take screenshots of your current balance, transaction history, and any error messages you encounter. If possible, record a video of your account dashboard as evidence.

2. File an Official Report:

Even if customer service is down, use every available channel to send a report — email, official social media accounts, the CIMB app (if working), and any physical branch if available. Keep records of your communication.

3. Notify the Authorities:

You can also file a report with the Bangko Sentral ng Pilipinas (BSP) and the National Bureau of Investigation’s Cybercrime Division. Financial fraud is a serious crime and reporting early can help investigations move faster.

4. Monitor Your Account Closely:

If you still have access, keep a close watch on your balance. Freeze or lock your account if the option is available on the app.

5. Stay Calm but Persistent:

Understand that banks operate under strict regulations. Investigations may take a few days or weeks, but maintaining pressure through consistent follow-ups can speed up resolutions.

How to Protect Yourself From Future Incidents

- Enable Two-Factor Authentication (2FA): Always activate 2FA for extra security on your accounts.

- Use Unique Passwords: Avoid reusing passwords across different sites. Use a reputable password manager if necessary.

- Be Wary of Phishing: Never click on suspicious links sent through SMS, email, or messaging apps.

- Regularly Monitor Your Accounts: Check your balances at least once a day, especially if large amounts are kept in a digital-only bank.

- Withdraw or Diversify Funds: Consider splitting large amounts across multiple banks to minimize risk exposure.

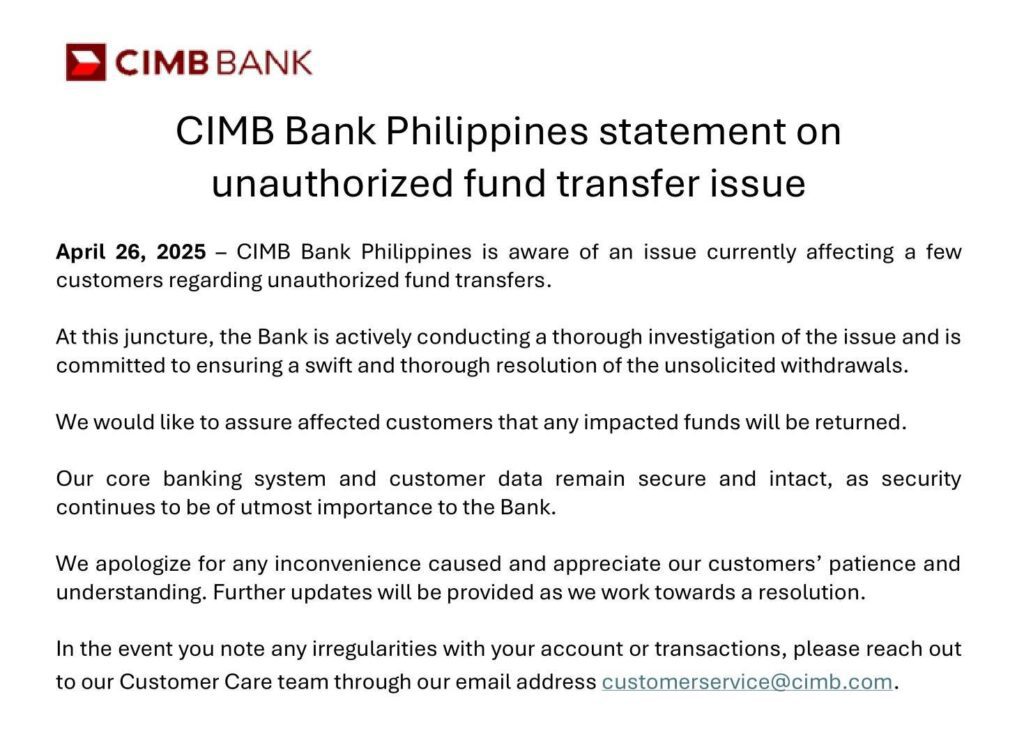

CIMB Bank Releases Official Statement

Amid growing public pressure and viral posts online, CIMB Bank has finally released an official statement.

While the statement offers a slight reassurance, many customers remain frustrated at the lack of real-time support and answers.

The current CIMB Bank situation is a harsh reminder that digital banking, while convenient, is not without risks. For now, affected customers are left grappling with fear and uncertainty, but there are legal protections in place. If you or someone you know has been affected, act swiftly and stay informed.

We will continue to update this story as more information becomes available here!