How to Break the Overspending Cycle

Ever walk out of a store with a bag full of “treasures” you didn’t even know you needed? You’re not alone. Overspending is a common pitfall that traps many of us in a cycle of debt and financial stress. Whether it’s the fleeting happiness of a new purchase, the pressure to keep up with trends, or the convenience of credit cards, overspending can quickly derail our financial goals.

This article delves into the psychology behind overspending, exploring the various factors that contribute to this behavior.We’ll also equip you with actionable tools and strategies to break free from the cycle and take control of your finances.

The Allure and the Trap

The urge to splurge often stems from a complex mix of emotional and social influences. Let’s face it, retail therapy can be incredibly tempting. After a long day, that new outfit or trendy gadget can offer a temporary escape from stress and a boost of self-confidence. Social media further intensifies this temptation by bombarding us with curated images of “perfect” lives filled with the latest styles and experiences. The fear of missing out (FOMO) kicks in, making us feel like we need to possess these things to feel happy and accepted.

Beyond Retail Therapy

However, the emotional satisfaction derived from shopping is fleeting. That initial high quickly fades, often replaced by guilt and regret when the credit card bill arrives. Furthermore, constantly chasing trends can create a never-ending cycle of buying and discarding, leaving us with overflowing closets and a lighter wallet.

The psychological aspect extends beyond short-term emotional gratification. Studies have shown that the mere act of swiping a credit card, as opposed to using cash, can make us feel like we’re spending less. This disconnect between the physical act of paying and the actual cost can lead to impulsive purchases and a distorted sense of our financial reality.

Breaking Free from the Overspending Cycle

The good news is, you can break free from the overspending cycle and achieve financial peace of mind. Here are some practical strategies to get you started:

Craft a Budget You Can Live With

Budgeting doesn’t have to be a restrictive chore. The 50/30/20 rule is a simple yet effective framework. Allocate 50% of your income towards essential needs like rent, utilities, and groceries. Dedicate 30% to wants like entertainment and dining. The remaining 20% should go towards savings or debt repayment. This rule is just a starting point – adjust the percentages based on your unique financial situation.Budgeting apps can be a valuable tool to track your spending and identify areas where you can cut back. Here’s an article where you can check a couple of budget-apps that can help you along the way!

Embrace Conscious Shopping

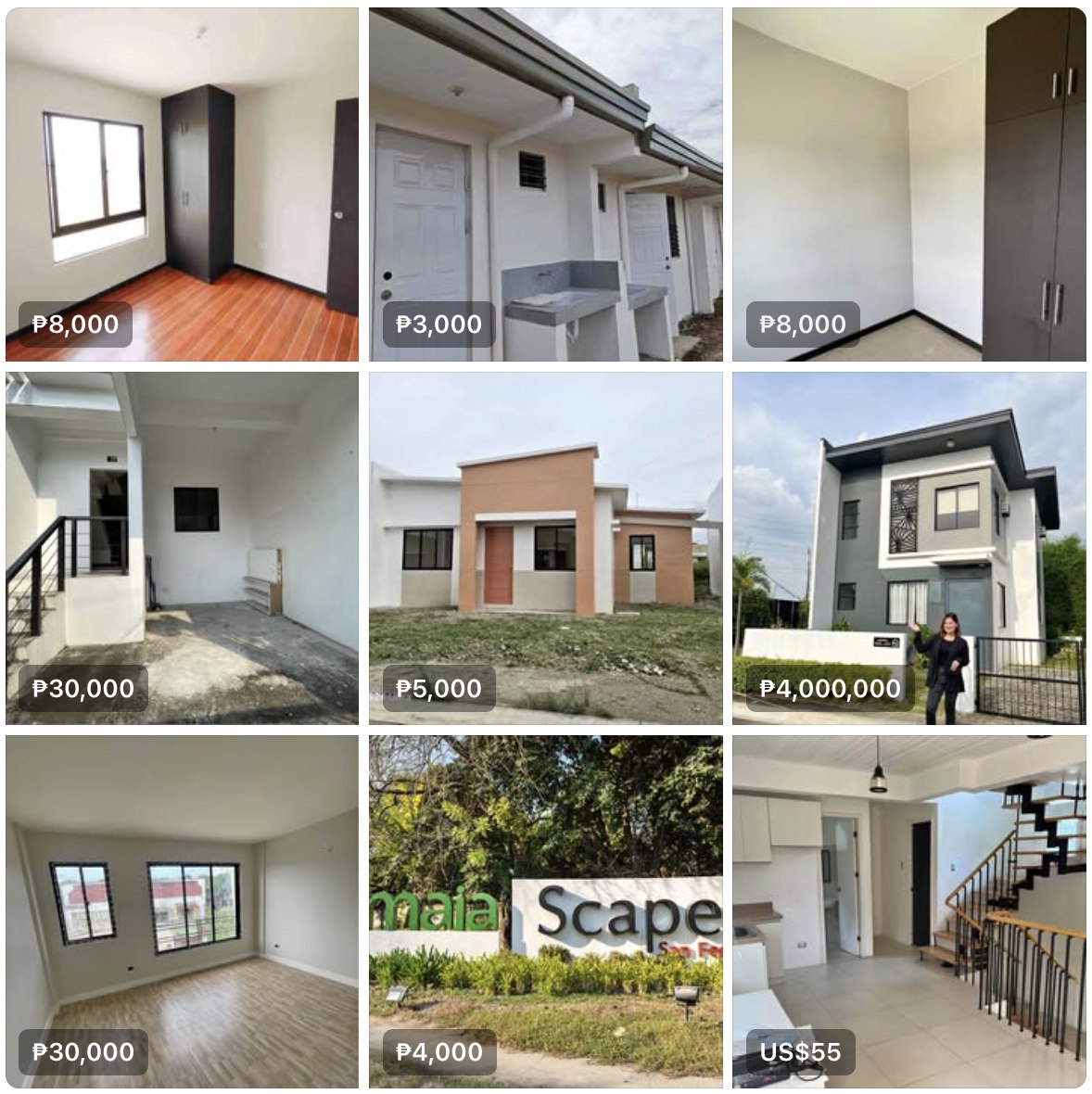

Sales can be a great way to save money, but only if you’re buying something you actually need. Before heading out, create a shopping list and stick to it. Avoid impulse buys by implementing a 24-hour cooling-off period. Ask yourself, “Will I still need or want this item in a day?” This simple trick can prevent you from accumulating clutter and unnecessary expenses.

Debt Management Strategies

If you’re already struggling with credit card debt, don’t despair. There are effective strategies to manage it. The snowball method involves paying off the smallest debts first, which can provide a sense of accomplishment and motivate you to keep going. The avalanche method targets debts with the highest interest rates first, ultimately saving you money in the long run.

Reward Yourself Wisely

We all deserve to celebrate our achievements. However, expensive shopping sprees can quickly negate your hard work. Choose alternative rewards that are enriching and don’t involve breaking the bank.Treat yourself to a hike with friends, a visit to a museum, or a night in with a good book.

Find Healthy Alternatives to Retail Therapy

Feeling stressed or overwhelmed? Retail therapy might seem like a quick fix, but there are healthier ways to cope. Exercise is a natural mood booster and can significantly reduce stress levels. Spending time in nature has proven benefits for mental well-being. Explore creative hobbies that allow you to express yourself and develop new skills. Reconnect with loved ones for social interaction and support.

Beyond the Basics

While these strategies provide a strong foundation, consider these additional tips for long-term success:

Unsubscribe from Temptations

Retailers often use email marketing to entice us with sales and promotions.Unsubscribing from these emails can reduce the constant exposure to tempting offers.

Follow Inspiring Accounts

Instead of social media feeds filled with unrealistic lifestyles, follow accounts that promote financial literacy and mindfulness. Learn from others who are on their own journey towards financial freedom.

Conquering overspending empowers you to take control of your financial future. Remember, achieving your financial goals is a journey, not a destination. There will be setbacks along the way, but with the strategies outlined above, you’ll be well-equipped to overcome them. Building a secure financial foundation allows you to breathe easier, pursue your dreams, and weather unexpected challenges.

Ready to explore ways to boost your income alongside your newfound budgeting skills? Check out this article for 10 part-time side hustle ideas to diversify your income streams. Remember, a little extra income can go a long way in achieving your financial goals!