The holiday season is a time of joy, celebration, and often, a boost in income thanks to your Christmas bonus or 13th month pay. However, with the excitement of the season, it’s easy to spend that hard-earned money without much thought. Instead of letting it slip through your fingers, why not use this financial windfall to achieve your personal and financial goals? Here’s a guide on how to make the most out of your 13th month pay this holiday season.

1. Start with a Plan for your 13th month pay

The first step to maximizing your 13th month pay is creating a solid plan. Before spending anything, sit down and list your priorities.

- Assess Your Financial Needs: Do you have any outstanding bills, loans, or debts that need to be settled? Paying these off should be a priority to avoid accumulating interest.

- Set a Budget: Divide your bonus into categories such as savings, investments, holiday expenses, and leisure.

2. Pay Off High-Interest Debt

One of the smartest moves you can make with your 13th month pay is to reduce or eliminate high-interest debts, such as credit card balances. Not only does this relieve financial stress, but it also frees up your monthly budget for other priorities.

Tip: Focus on paying debts with the highest interest rates first (the avalanche method) or tackle smaller debts for quick wins (the snowball method).

3. Save for the Future

Consider using part of your 13th month pay to boost your savings. Whether it’s for an emergency fund, future travels, or a big purchase, having money set aside can provide peace of mind.

- Emergency Fund: Aim for at least three to six months’ worth of expenses in case of unforeseen circumstances.

- High-Yield Savings Account: Park your money in an account that earns better interest than traditional savings accounts.

4. Invest Wisely

Investing a portion of your 13th month pay can help grow your money over time. Explore options such as:

- Mutual Funds or Stocks: Ideal for long-term goals like retirement or education.

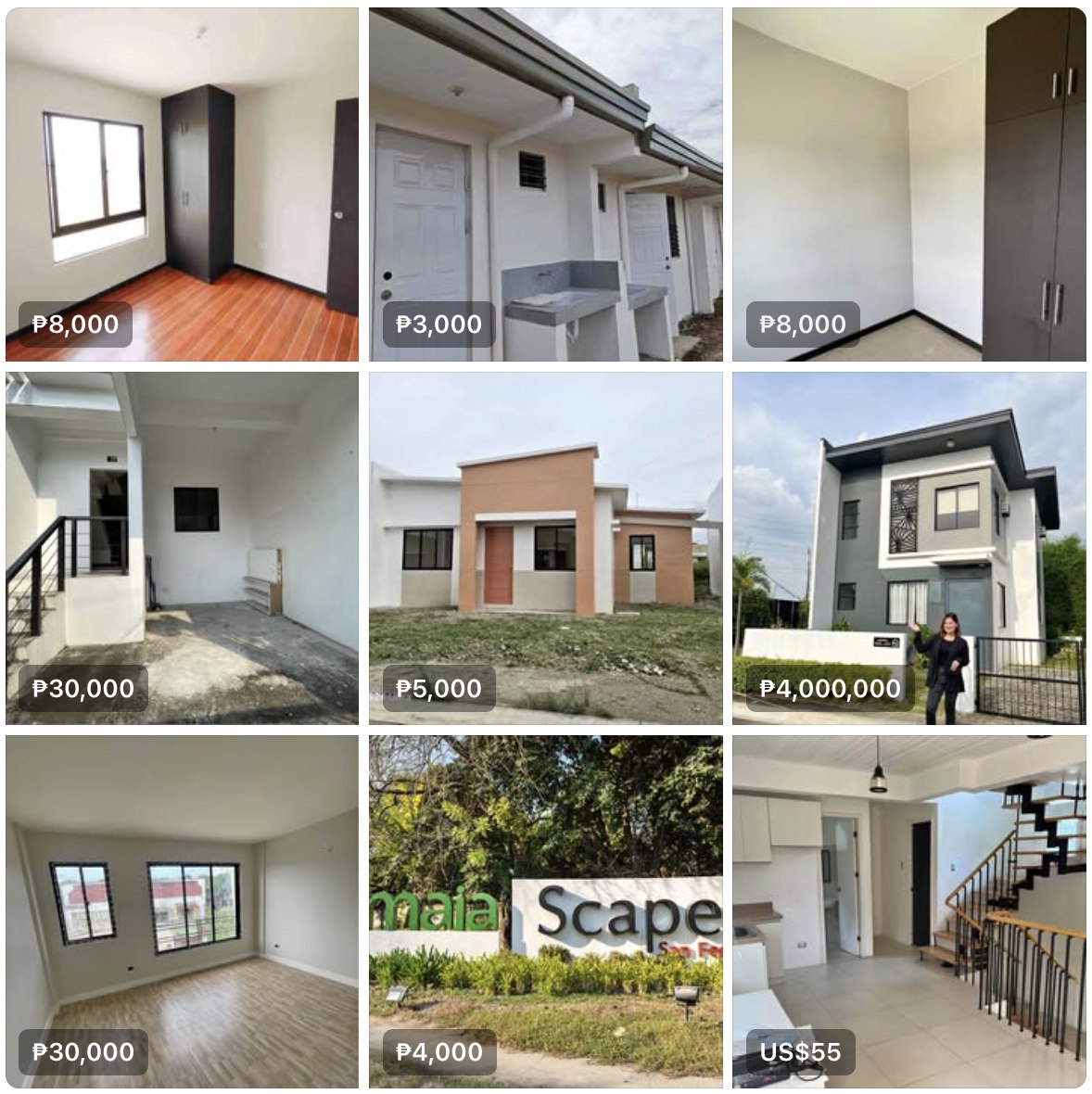

- Real Estate Crowdfunding: A growing trend in property investment that requires less capital upfront.

- Retirement Funds: Contribute to your pension plan or open an individual retirement account (IRA).

Reminder: Do your research or consult a financial advisor before diving into investments.

5. Plan for Holiday Expenses Smartly

It’s tempting to splurge on gifts and celebrations during the holidays. While sharing your blessings is important, be mindful of your spending.

- Make a Gift List: Identify who you want to give presents to and set a budget for each.

- Opt for Thoughtful, Budget-Friendly Gifts: Homemade items or personalized tokens often mean more than expensive ones.

- Limit Luxuries: You don’t need to host a grand holiday party. Focus on meaningful moments with loved ones instead.

6. Give Back

The holiday season is also a time for giving. Consider using a portion of your 13th month pay to support a cause you believe in. Whether it’s donating to a charity, helping out a community project, or surprising someone in need, the act of giving often brings fulfillment beyond material rewards.

7. Reward Yourself (Responsibly)

It’s okay to use part of your bonus to treat yourself. After all, you’ve worked hard all year! The key is moderation. Allocate a specific portion for leisure, such as dining out, buying that gadget you’ve been eyeing, or taking a short trip.

8. Plan for the Next Year

Lastly, use this year’s 13th month pay as a stepping stone for better financial habits. Reflect on how you’ve managed your money this year and set financial goals for the coming year.

- Build a Financial Plan: Establish a clear strategy for saving, spending, and investing.

- Track Your Expenses: Use budgeting apps to monitor your spending habits.

- Take Financial Courses: Invest in learning about money management.

Your 13th month pay is more than just extra money—it’s an opportunity to improve your financial well-being. By planning ahead, paying off debts, saving, investing, and sharing with others, you can maximize its impact not just for the holidays, but for the months to come. The choices you make today will set the tone for a brighter financial future.

check out this site for more tips!

for more content like this check out this link!