In response to the dynamic evolution of commerce, particularly accelerated by the COVID-19 pandemic, the Bureau of Internal Revenue (BIR) in the Philippines issued Revenue Memorandum Circular No. 60-2020 (full memorandum here: https://bit.ly/3SCMN1P) on June 1, 2020 for Philippine Tax Compliance for Online Businesses. This circular serves as a comprehensive guide, outlining the obligations incumbent upon individuals engaged in business activities through electronic platforms and media. Delving deeper into the intricacies of this circular provides online entrepreneurs with a thorough understanding of their responsibilities, potential exemptions, and avenues for compliance.

1. Registration and Compliance Requirements: RMC No. 60-2020 mandates that all individuals conducting business and generating income through digital transactions must register their enterprises with the BIR. The circular provides a grace period until July 31, 2020 (later extended to September 30, 2020 by RMC 92-20) for online sellers to complete registration or update their existing status without incurring penalties. During this transition period, voluntary declaration and settlement of previous transactions were encouraged to facilitate compliance. Failure to register or fulfill tax obligations may result in penalties, emphasizing the importance of adherence to regulatory requirements.

2. Guidelines for Newly Registered Online Sellers: Newly registered online sellers are provided with specific guidelines to ensure seamless compliance with tax regulations. These guidelines include:

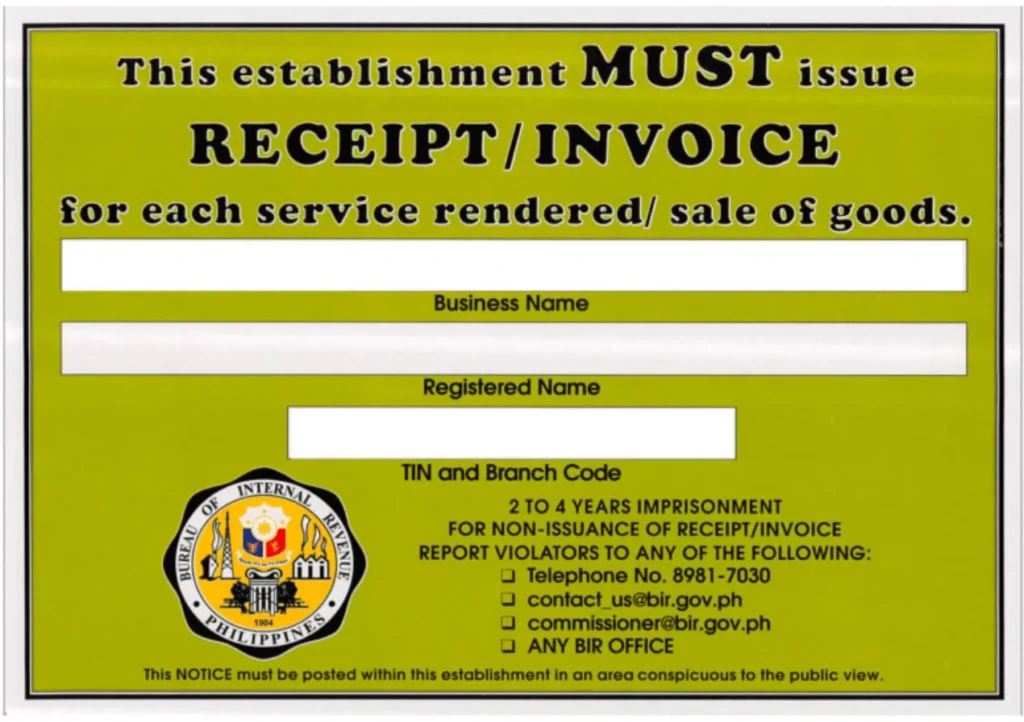

- Issuing BIR-registered sales invoices or official receipts for every transaction.

- Maintaining meticulously organized books of accounts and other pertinent accounting records.

- Withholding taxes where applicable.

- Filing requisite tax returns promptly.

- Ensuring the timely and accurate payment of taxes owed.

3. Background and Context: Amidst the COVID-19 pandemic, online selling experienced an unprecedented surge, serving as a vital lifeline for many communities grappling with lockdown measures. While RMC No. 60-2020 may appear novel, previous directives such as RMC No. 55-2013 have addressed taxpayer obligations pertaining to online business transactions. Understanding the historical context of these regulations provides valuable insights into their evolution and implementation.

4. Tax Exemptions and Benefits: Online sellers in the Philippines may be eligible for various tax exemptions and benefits, subject to certain conditions and qualifications. These include:

- Exemptions for marginal income earners, whose gross sales fall below a specified threshold, from several tax obligations, including VAT and income tax.

- Benefits for Barangay Micro Business Enterprises (BMBEs), registered under Republic Act No. 9178, such as income tax exemptions and other associated benefits.

5. Conclusion: While navigating the regulatory landscape of taxation for online sellers may seem daunting, a comprehensive understanding of the guidelines, exemptions, and avenues for compliance empowers entrepreneurs to operate ethically, legally, and efficiently. Recent reforms, such as the elimination of the Mayor’s Permit requirement under RMC No. 57-2020, have streamlined the registration process, making entrepreneurship in the digital sphere more accessible. Additionally, the option of opting for an 8% tax based on gross income provides online sellers with a potentially favorable alternative to standard income tax rates.

In summary, by thoroughly understanding the nuances of taxation guidelines and capitalizing on available incentives, online sellers can effectively navigate the regulatory landscape while also bolstering the burgeoning digital economy of the Philippines. With recent reforms streamlining registration processes and the option to opt for an 8% tax based on gross income, entrepreneurs have accessible pathways to operate ethically and contribute positively to the dynamic online marketplace.