Buying a home is one of the biggest financial decisions a person can make. For many low-income Filipinos looking for affordable housing, the idea of “rent to own” sounds like an attractive deal—why keep renting when you can own? But here’s the truth: most so-called “rent to own” deals in the Philippines are not what they seem.

The Deceptive Marketing Tactic

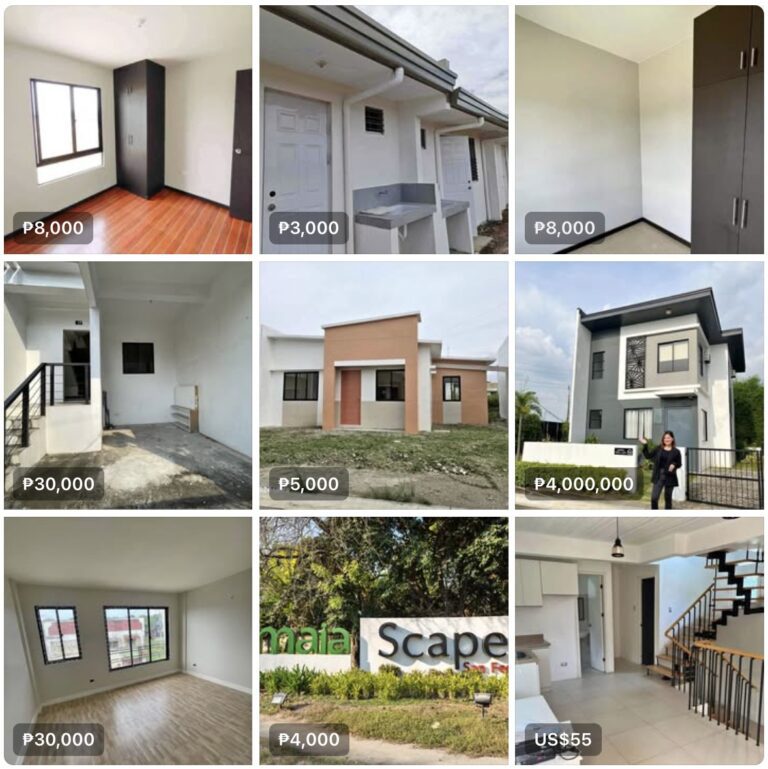

Real estate agents and developers frequently misuse the term “rent to own” when advertising townhouses and low-cost housing in provincial areas. You’ve probably seen posts on Facebook Marketplace or heard sales agents say:

- “Lipat agad after downpayment!”

- “Instead of renting, pay for something you’ll own!”

- “For only ₱5,000 per month, you get your own home!”

At first glance, this sounds like a great deal. You move in right away, and your monthly payments supposedly go toward owning the house. But in most cases, what they’re actually selling isn’t a real rent to own contract—it’s an installment plan (hulugan) or mortgage amortization.

What ‘Rent to Own’ Actually Means

In a true rent to own agreement, the buyer rents the property first, usually for a set period (e.g., 2-5 years). A portion of the rent payments go toward the eventual purchase of the property. After the rental period, the buyer has the option—but not the obligation—to buy the house at a pre-agreed price.

In contrast, most Philippine developers advertising “rent to own” are actually offering bank financing or in-house financing. This means you’re not renting—you’re committing to a long-term loan. If you fail to make payments, you don’t just lose the house—you lose all the money you’ve already paid.

The ‘Lipat Agad’ Trap

Many low-cost housing projects emphasize “lipat agad” (move in immediately) after a small down payment. This makes buyers feel like they already own the home. But the reality is:

- The low monthly payments they advertise are just the amortization, not rent to own payments.

- You’re locked into a financing contract, often with high interest rates and hidden fees.

- If you miss payments, you risk foreclosure and eviction.

- Some developers use “pre-selling” tactics, meaning you might move into a house that isn’t even fully built or legally titled yet.

- Some developers promise rent to own but fail to deliver the proper documentation, leaving buyers in legal limbo.

Why This Misuse of ‘Rent-to-Own’ is a Problem

- It Misleads Buyers – Many people think they are renting while slowly owning the home, but they are actually taking on a home loan.

- It Downplays the Risks – Unlike renting, missing payments on an installment plan can result in severe financial loss.

- It Exploits First-Time Homebuyers – Those who don’t understand financing may fall for “lipat agad” offers, thinking it’s a risk-free way to own property.

- It Can Lead to Hidden Costs – Some buyers find out too late that they must pay additional fees for processing, insurance, or hidden penalties for missed payments.

- Lack of Regulation – The Philippines lacks strong enforcement of consumer protection laws in real estate, making it easier for developers to get away with misleading terms.

How to Protect Yourself

If you’re looking for affordable housing and see an ad for “rent to own,” do the following:

- Ask for a contract – A legitimate rent to own deal should outline rental terms before ownership. If it’s just a loan, it’s not rrent to own.

- Check the fine print – Look for terms like “amortization,” “financing,” or “installment.” These indicate a loan, not a rental agreement.

- Be wary of ‘lipat agad’ schemes – Moving in right after a down payment does not mean you own the home. You’re still subject to financing conditions.

- Compare real rent to own options – Some private landlords and developers do offer legitimate rent to own schemes, but they are rare. Do thorough research before committing.

- Check the developer’s reputation – Look for reviews, past buyer experiences, and any legal complaints against them.

- Consult a lawyer – If you’re unsure about a contract, seek legal advice before signing anything.

Alternatives to Consider

If your goal is to own a home but you’re struggling with financing options, here are some alternatives:

- Government Housing Programs – Check agencies like Pag-IBIG for more affordable and regulated housing loans.

- Cooperative Housing – Some communities offer shared ownership schemes with more flexible payment options.

- Delayed Purchase Agreements – Some landlords may allow a rental period before you fully commit to buying.

The misuse of “rent to own” in Philippine real estate is a serious issue that preys on first-time and low-income homebuyers. By understanding the difference between rent to own and an installment plan, you can make a smarter decision and avoid financial pitfalls.

Before you sign anything, ask questions, read the fine print, and remember: if it sounds too good to be true, it probably is.

Always approach real estate deals with caution and educate yourself to make the best financial decision for your future.

To better understand your rights as a homebuyer and the legal aspects of rent-to-own agreements, here are key laws and resources that clarify these transactions:

| Law / Regulation | Description | Source |

|---|---|---|

| Republic Act No. 6552 (Maceda Law) | Protects buyers in real estate installment plans, granting rights like grace periods and refund entitlements. | LawPhil |

| DHSUD FAQs on Maceda Law | Clarifies buyer rights under Maceda Law, including refund eligibility and grace periods for defaulted payments. | DHSUD |

| Legal Framework for Lease-to-Own Agreements | Discusses the legal considerations for rent-to-own contracts in the Philippines. | Respicio & Co. |

| Understanding Rent-to-Own Condominium Agreements | Provides insights on lease-to-own agreements specifically for condominiums. | Lawyer Philippines |

| Republic Act No. 9653 (Rent Control Act of 2009) | Regulates rent increases and tenant protections, relevant for understanding rental agreements. | MoneyMax |

For more tips, click here!