Introducing the BIR Digital TIN ID: Revolutionizing the way individuals verify their tax identification and access government services, this innovative digital solution offers efficiency and convenience in a modern, signature-free format.

- If you can’t recall your TIN, visit the nearest BIR office and request a TIN Verification Slip, which displays your registered name, address, TIN, and RDO Code location.

- If your BIR TIN account lacks an email address, you must update it by downloading BIR Form No. S1905 (Registration Update Sheet) from the BIR website, as outlined in Annex A of RMC No. 122-2022. link here: https://bit.ly/42u9R5Y

- Complete Form S1905 with your PERMANENT EMAIL, address, RDO Code, TIN, and other required details, then sign it. Take a picture or scan the form with your smartphone or computer/printer.

- Submit the softcopy (picture or scan) of the form to the BIR email address corresponding to your RDO code. You can locate the relevant BIR email address in the provided PDF link (per Annex B of RMC 122-2022). link here: https://bit.ly/42riRc9

- Await an email confirming that your ORUS TIN account with the BIR has been updated with your email address.

- Visit the official BIR ORUS website at https://orus.bir.gov.ph. Register your TIN and email under NEW REGISTRATION > AS AN INDIVIDUAL > and CREATE AN ACCOUNT. Provide the necessary details (including your existing TIN). Once you’ve created your BIR ORUS account, log in, select “generate DIGITAL TIN ID,” fill in the required details, and click “update” to print your digital TIN ID.

Here are some key features of the new BIR Digital TIN ID:

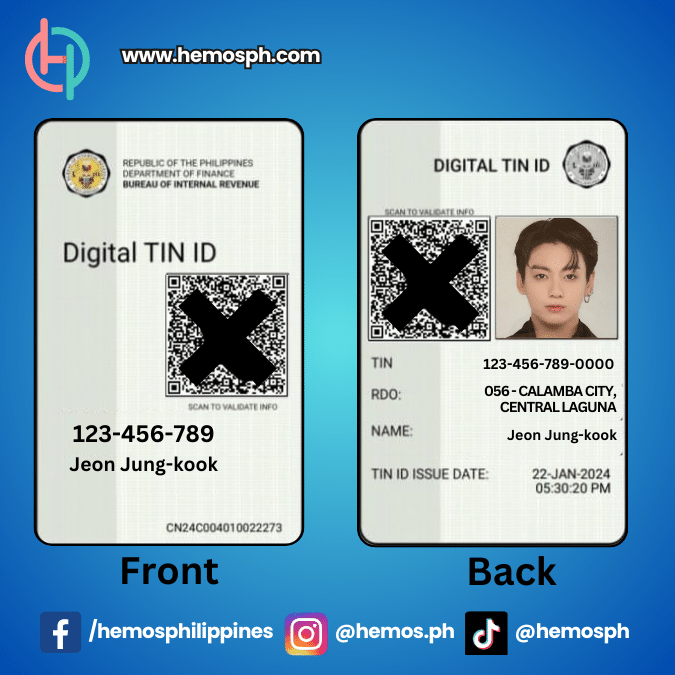

A. It functions as a reference for the taxpayer’s TIN and is recognized as a valid government-issued ID accepted by various government agencies, local government units, banks, employers, and other institutions. Its authenticity can be verified online via the ORUS system using the provided QR Code.

B. Unlike physical TIN cards, the Digital TIN ID doesn’t need a signature. Its authenticity can be verified online through ORUS simply by scanning the QR code on the Digital TIN ID using a mobile device camera.

C. Individual taxpayers with existing TINs can apply for the Digital TIN ID through ORUS. Users must enroll their accounts on the ORUS platform.

D. The Digital TIN ID is a permanent identification document. Both the physical TIN card and Digital TIN ID remain valid, eliminating the need to obtain a physical card if you possess a Digital TIN ID.